Water Treatment Equipment Industry - 2023

To read the full version of this report, apply for our free trial

Read the Full Article

SPEEDA Industry Report

Our Industry research reports provide you a fundamental understanding of hundreds of industries ranging from major to niche sectors, including new tech-focused trends. Reports organized by Asia-focused countries are logically structured to cover key information such as market size, value chain, key regulations, competitive landscape, and more.

Users can utilize the industry reports to get a bird's eye of the industry quickly (covered within 3,000 words), also combining it with our extensive private company database to further understand key players and trends related to the specific industry.

The reports focus on below 3 key segments of the industry which assist users with understanding where to focus on for further deep-dive research.

Report Overview: Water Treatment Equipment Industry

Salient Features

- Water treatment equipment for industrial use in Vietnam is entirely imported, as local companies are not capable of producing on a large scale and meeting high technical standards for such equipment. In contrast, local companies dominate the water purifier segment.

- Water purifier brands in Vietnam were largely unknown in the early 2010s, until consumer awareness grew and local companies ran successful ad campaigns.

- Leading local water purifier manufacturers tend to specialize solely in their flagship water purifying products, while mixed manufacturers expand rapidly into other product categories such as home appliances, kitchen appliances, and refrigeration.

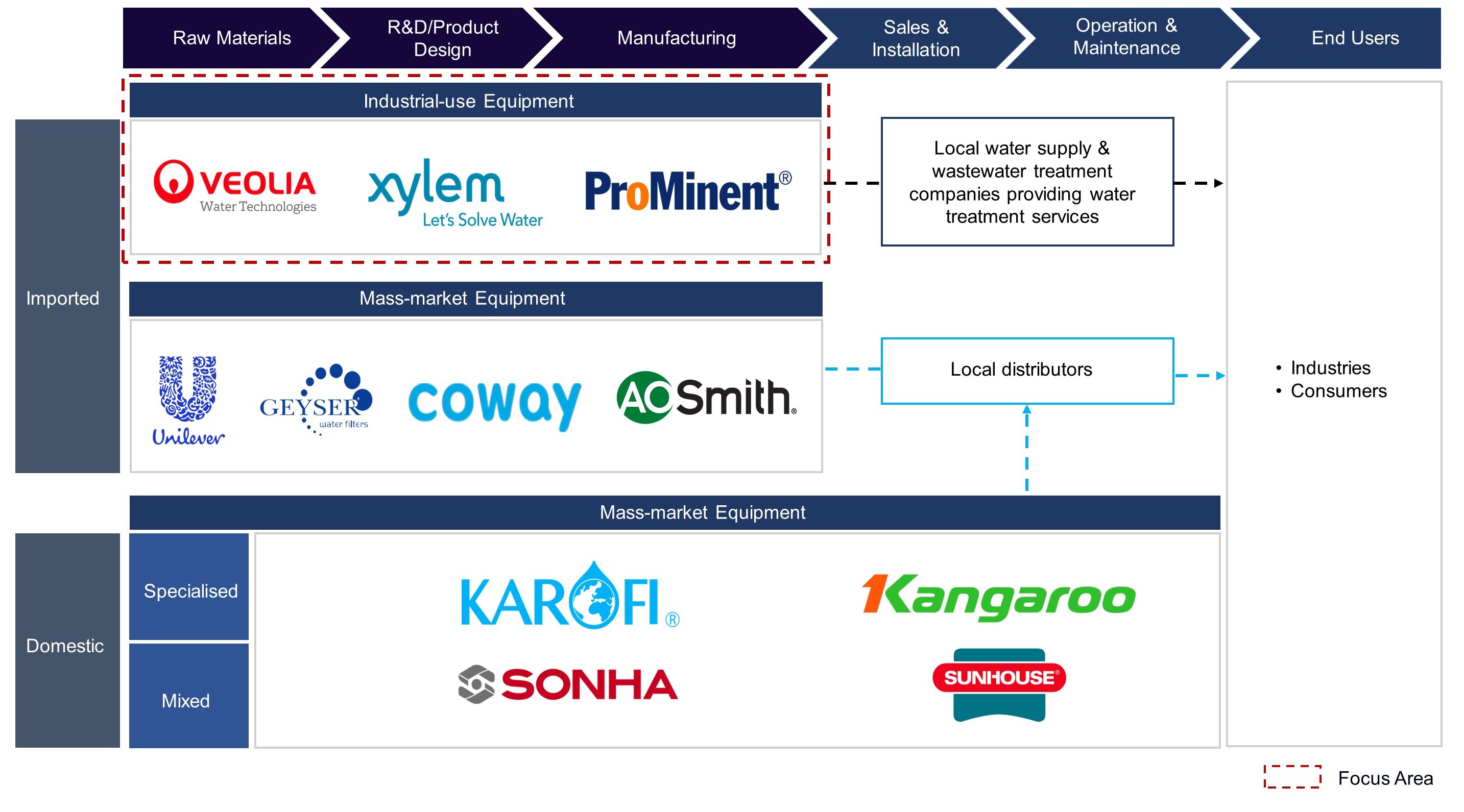

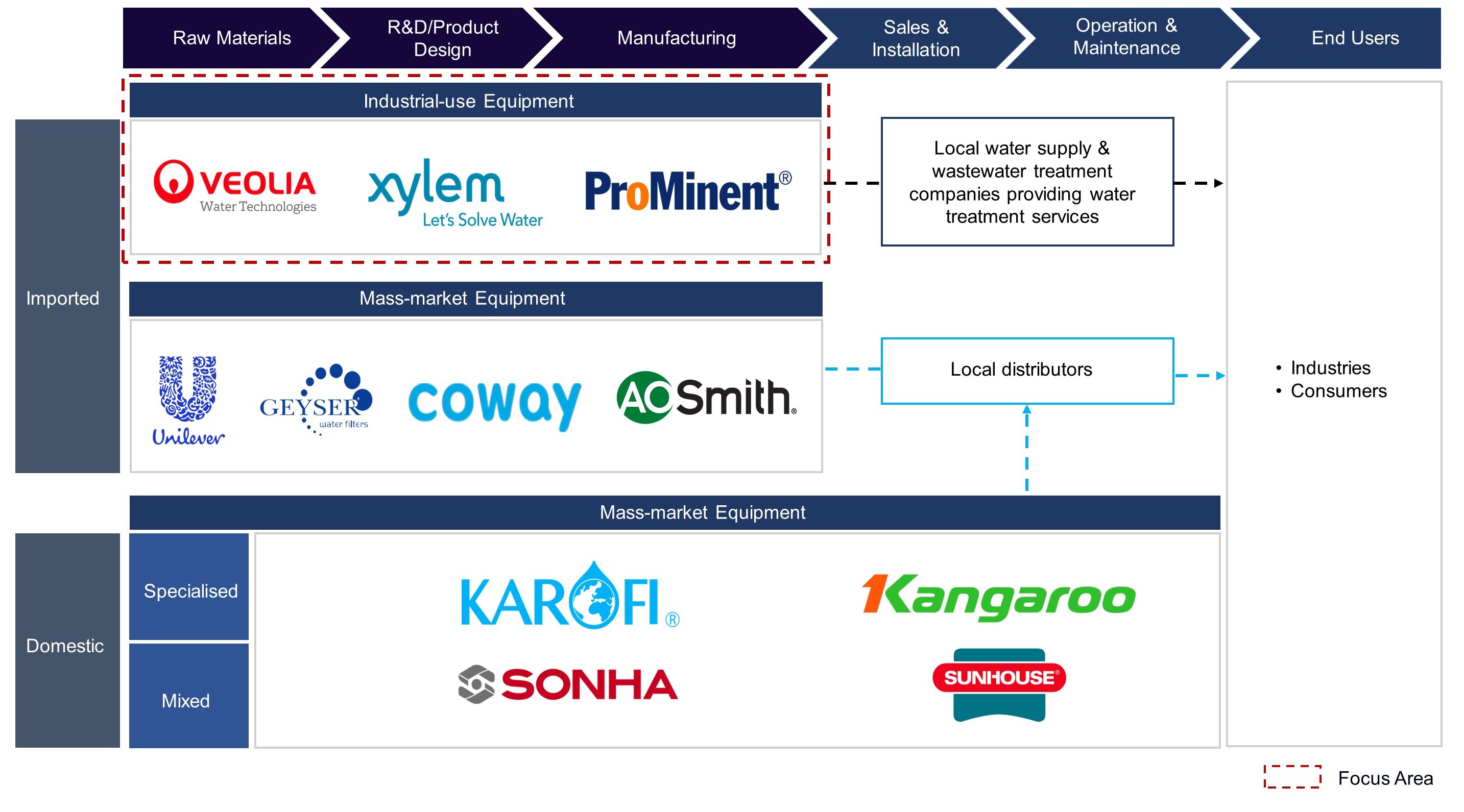

Value Chain/Business Model

- The water purifier market can be segmented into Specialised and Mixed water purifier producers.

- Specialised water purifier producers enter the market and position themselves as water purifier manufacturers, and water purifiers remain their flagship product with which consumers typically associate their brands.

- Mixed water purifier producers do not primarily produce water purifiers; instead, they gain their brand recognition from other products.

- All leading local water purifier manufacturers have their own retail stores in Vietnam and also distribute products through local electronic supermarkets.

Other Points

Water Treatment Equipment Industry Value Chain

Report Index

Industry Overview

- Water Treatment is Broadly Classified into Drinking Water and Wastewater Treatment; Industry Dominated by Foreign Players

- Water Treatment Equipment Exported into Vietnam by Foreign Companies

- Government Initiatives Aid Industrial-Use Water Treatment Equipment Segment, Yet Implementation Show Little Progress

Market Trends

- New Investments in Wastewater Treatment Facilities to Spur Demand for Municipal Wastewater Treatment Equipment

- Vietnam to Remain a Significant Importer of Filtering/Purifying Machinery Due to Insufficient Existing Water Treatment Facilities

Competitive Trends

- Local Players Gain Prominence Alongside Growing Consumer Awareness and Successful Ad Campaigns; Karofi Became the Largest Player Despite Its Late Entry

- Veolia Water Solutions & Technologies Vietnam: Strategic Partner with Wasol Corporation to Offer Products to Vietnam's Market

- Karofi Group: Most Recognisable Water Purifier Brand and Market Leader in Vietnam

- Viet Nam Australia Refrigeration Electrical Engineering Group: Leading Home Appliance Brand Attempting Electric Vehicle Production