Báo cáo ngành

Credit Card Industry in ASEAN

Summary

Explore the market trends including the top ASEAN countries, and the emerging challenges, including card fraud and the rise of digital payment methods. (Updated: 01 November 2023)

Introduction: The Credit Card Industry

The Industry holds a significant position in the realm of finance. In this report, we aim to define the Credit Card Industry as establishments in this sector primarily focusing on issuing credit cards and collecting balances from their customers. We’re eager to present an overview of the industry and trends in the ASEAN region and shed light on the forthcoming challenges the sector might encounter.

Overview of the Credit Card Industry Global Market

The Credit Card Industry holds a significant position in the realm of finance. In this report, we aim to define the Credit Card Industry as establishments in this sector primarily focusing on issuing credit cards and collecting balances from their customers. We’re eager to present an overview of the industry and trends in the ASEAN region and shed light on the forthcoming challenges the sector might encounter.

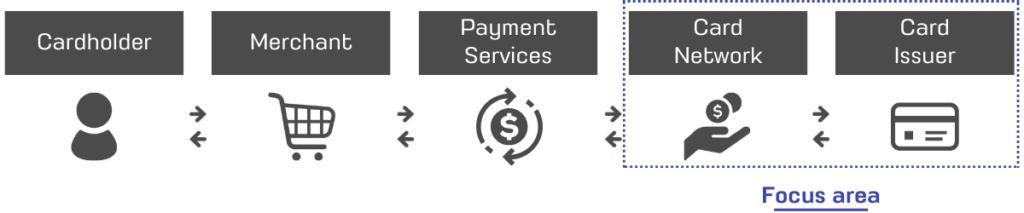

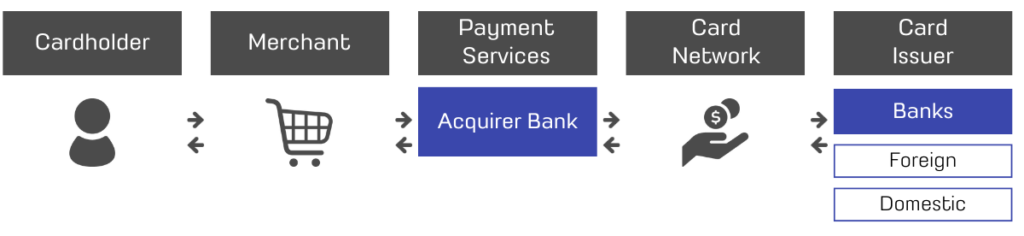

Every credit card transaction encompasses several key entities: the cardholder, merchant, payment service provider (PSP), merchant acquirer, card network, and card issuer.

It’s important to note that merchants are charged a fee for processing credit card payments This fee is subsequently directed to “Card Issuers” and “Card networks”. Key players in the Credit card industry can be categorised broadly into these two segmentations, which fall within the scope of this report. Card networks play a crucial role in overseeing the processing of card payments by providing a secure network infrastructure. On the other hand, card issuers are responsible for granting credit card loans to their cardholders.

The two prominent global entities, Visa (USA) and Mastercard (USA) operate exclusively as a card network, maintaining similarity in their functions.

In contrast, entities such as American Express (USA) or Discover Financial Services (USA; Discover) offer both card issuing and merchant acquiring services, all while functioning as card networks. Notably, American Express focuses largely on credit cards, while other leading card network entities diversify their offering with an array of payment card types, including debit and prepaid cards. Given these differences in business models, revenue streams distinctly differ across card networks.

Credit Card Payment Process (World)

Credit Card Industry in ASEAN

Delving into the growth trajectory of credit card numbers by region, the Asia-Pacific stands out as the primary contributor, with China taking the lead. The growth of the e-commerce market in the region has likely supported the rise of credit card utilisation in Asia-Pacific. However, while credit card usage is increasing, the industry grapples with challenges posed by the emerging cashless payment alternatives. These include debit cards and other innovative payment methods, like mobile wallets.

Here’s a closer look at the key markets in the ASEAN region.

Singapore

Singapore

Overview: The frontrunner of the ASEAN-6 nations

The World Bank highlights that Singapore held the highest credit card ownership rate. The country positions itself as the frontrunner with the most mature credit and debit card market among the ASEAN-6 nations. The popularity of credit cards in the country can be attributed to its well-banked population, complemented by an expansive card acceptance network.

Insights from the payment service provider Worldpay reveal that credit card payments were the go-to option for point-of-sale (POS) and e-commerce transactions in 2022. However, the dominance of traditional credit cards is expected to wane in the face of burgeoning digital payment alternatives in the near future.

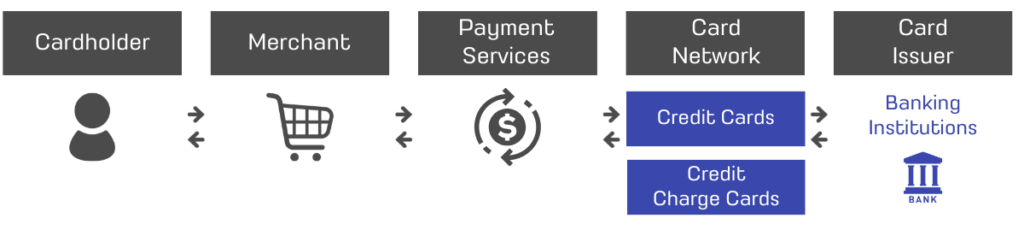

Value Chain: Issuing both credit and charge cards

Singapore’s banking sector has been instrumental in issuing both credit and charge cards, catering to the diverse needs of both personal and business users. The country is receptive to both credit cards and charge cards, the latter requiring full payment monthly.

Notably, banking institutions are the primary credit card issuers. This sector is led by commercial banks, including DBS Group Holdings, Oversea-Chinese Banking Corp (OCBC), and United Overseas Bank (UOB).

Value Chain of Singapore’s Credit Card Industry

Thailand

Thailand

Overview: Market shows an upward trajectory

Thailand’s credit card penetration rate may trail Singapore, though the market shows an upward trajectory, ranking second in the ASEAN region. The Industry’s main players can be divided into “Banks” and “Non-Banks” with large banks dominating the market share. However, 2022 saw a decline in their credit card outstanding year over year. In contrast, Non-Banks experienced growth.

An emerging trend in Thailand is the “Buy Now Pay Later” payment option, primarily offered by Non-Bank companies. This option allows customers to make purchases and defer payments with minimal or no interest charges. This trend is especially popular among the younger generation and showcases the industry’s adaptability. However, concrete regulations for this payment model have not yet been established.

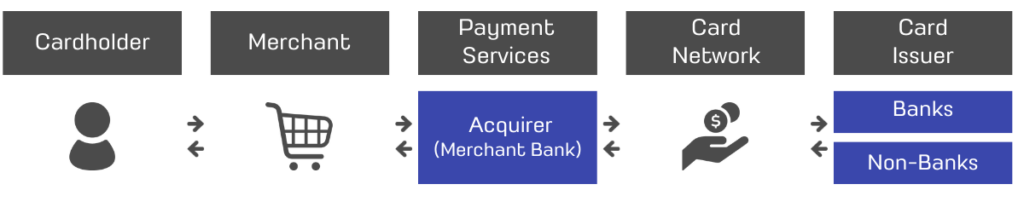

Value Chain: Banks and Non-banks responsible for issuing credit cards

In Thailand, both Banks and Non-banks are responsible for issuing credit cards, processing transactions, and offering various card-related services. Banks typically target a broader customer segment and have high per-card spending. In contrast, Non-banks issue more credit cards, as they typically have a more specialised focus with a limited range of offerings. Importantly, many major Non-banks offer multiple loans or insurance products besides credit cards, contributing significantly to their revenue.

Value Chain of Thailand’s Credit Card Industry

Malaysia

Malaysia

Overview: High credit card penetration rate

Ranked third after Singapore and Thailand, Malaysia boasts a notable credit card penetration rate. The industry is witnessing steady growth, driven by factors such as increased consumer purchasing power, a shift towards a cashless economy, the expansion of payment infrastructure, and the surge in e-commerce, especially in the post-pandemic era. However, similar to other regions, the rising popularity of alternative digital payment technologies – including electronic wallets, Mobile Banking, Internet Banking, and Debit Cards – offers consumers added convenience in managing their finances. This presents a challenge to the conventional credit card industry.

From a regulatory perspective, the government supervises the market continuously, by Bank Negara Malaysia (BNM) implementing regulations to improve consumer security and combat fraud.

Value Chain: Comprised by various stakeholders

The credit card industry in Malaysia comprises various stakeholders: cardholders, issuing banks, merchants, acquirer banks, and credit card networks. All operate under the aegis of BNM. While prominent global companies like Visa, Mastercard, UnionPay, and American Express serve as principal credit card networks, a mix of foreign and domestic players function as card issuers.

Value Chain of Malaysia’s Credit Card Industry

Future Challenges in the Market

Industry Continues to Suffer from Card Fraud:

Despite significant advancements, unauthorised card transactions have raised alarms in recent years, spotlighting concerns about credit card fraud.

Credit Card Fraud manifests in two primary forms: Card-Not-Present (CNP) and Card-Present fraud. CNP Fraud predominantly transpires online when cardholder information is stolen and used illegally without the physical presence of the card.

Regional regulatory frameworks shoulder the responsibility for combating these frauds and enhancing security protocols. For instance, the Association of Banks in Singapore (ABS) has taken the initiative to enhance credit card security standards in response to these emerging challenges. It’s encouraging to observe ASEAN nations proactively bolstering higher credit card security standards.

Emergence of Digital Payment Modes as Contenders:

The credit card industry faces stiff competition from the rise of digital payment solutions. These platforms, revered for their immediacy and convenience, are ushering in a paradigm shift in the financial sector, challenging the traditional credit card industry. For instance, digital wallets have rapidly become the go-to payment method for many, reflecting the industry’s evolving dynamics. It is forecasted that digital payment methods might eclipse credit card transactions in the near future.

In summation, while the ASEAN Credit Card industry showcases potential and growth, it is imperative for the players to remain agile and perceptive to sustain its relevance in the evolving financial landscape.

Accelerate your business with the local company and industry database

Understanding the industry, its dynamics, value chain, and competitive landscape can elevate your market analysis, facilitating robust business strategising and client interaction preparations.

Conventional desktop research, though exhaustive, often consumes excessive time.

Speeda Industry Reports are logically structured to cover key information, such as the market outlook, key financial metrics, value chains, regulations, and competitive landscapes encapsulating potential details like market forecasts. Encompassing over 560 distinct industry categories covering major to niche sectors, meticulously curated and segmented by region, it will enable you to detect the market and obtain a holistic industry perspective to expedite your research.

Try our free trial to read the full report on the credit card industry and other 3,000 reports written by local analysts. Gain insights for your business and bring more efficiency.