Báo cáo ngành

Automobiles Industry in Vietnam

Summary

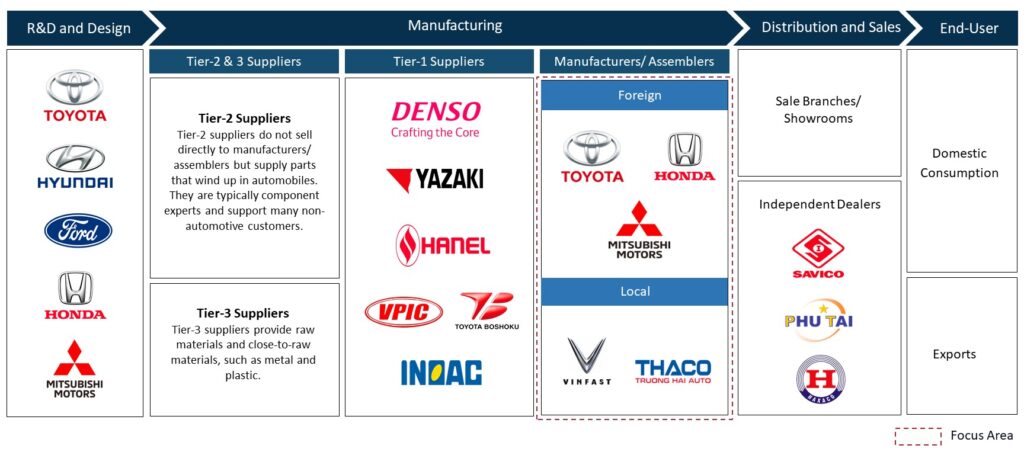

Vietnam’s auto industry is nascent, with limited localisation. Foreign entities dominate, being highly integrated in R&D, design, manufacturing, and sales. Local manufacturers focus on assembly, requiring less technical expertise.

A Quick Dive into the Global Automobile Industry

The automobile industry is evolving globally, with advancing technologies and a shift towards sustainability driving the change.

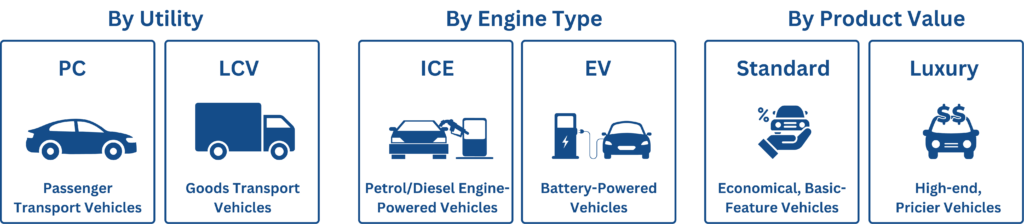

Automobiles can be classified by utility into two main categories: Passenger Cars (PCs) and Light Commercial Vehicles (LCVs). PCs are motor vehicles with at least four wheels, designed for the transportation of passengers, and typically equipped with no more than eight seats in addition to the driver’s seat. LCVs are also motor vehicles with at least four wheels, used primarily for the transportation of goods. The weight capacity typically ranges from 3.5 to 7 tons, depending on local and professional definitions.

Automobiles can also be categorised by engine type, which includes Internal Combustion Engines (ICE) and Electric Vehicles (EVs). Further, they can also be differentiated by product value, falling into the categories of standard and luxury vehicles.

Classification of Automobiles

Additionally, Sports Utility Vehicles (SUVs) which combine elements of road passenger cars and off-road vehicles, are categorised as either PCs or LCVs depending on the regulations of each country. SUVs have emerged as the most profitable segment and have seen the highest sales growth among PCs in recent years.

Global Trends and Competitions in the Automobile Industry

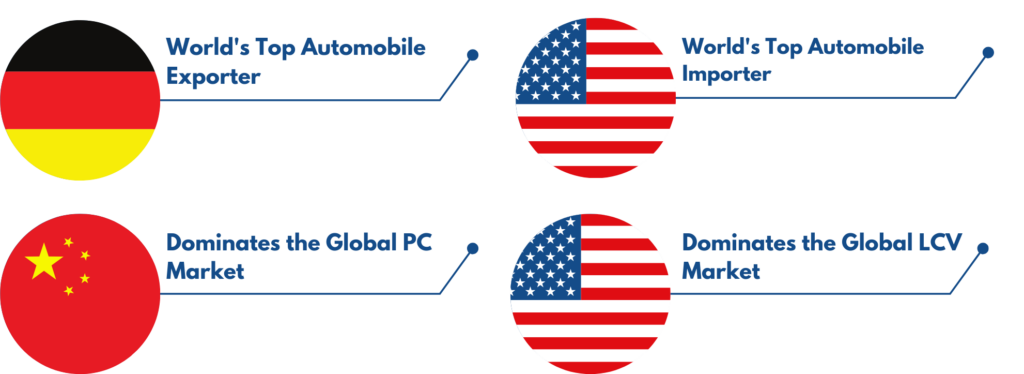

Germany has consistently ranked the title of the world’s largest automobile exporter. Meanwhile, the US remains at the forefront in terms of the global automobile import value. Both the US and Germany have been prominent players in the global automobile trade.

China boasts the world’s largest middle-income population, creating a robust demand base for Chinese auto manufacturers. The government’s protective measures against foreign monopolisation have further bolstered industry growth, making them leaders in the global PC market. In 2022, India outpaced Japan and the US to secure the world’s second-largest position in PC sales by volume, driven by the easing of supply chain disruptions, a surge in demand for SUVs, and the introduction of new products.

The US has maintained the leading position in LCV production due to the popularity of pickup trucks. These vehicles offer off-roading options and serve as both a car and a truck, providing ample cargo space.

World’s Top Leading Automobile Companies

The global automotive industry’s top six players: Volkswagen, Toyota, Mercedes, Ford, General Motors (GM), and Honda accounted for around 42% of the market in 2022 in terms of units sold (including Heavy Commercial Vehicles). The industry exhibits low concentration, with players competing based on pricing, multiple brands catering to different customer segments, and intense R&D expenditure to satisfy Connected, Autonomous, Shared and Services, and Electrification (CASE) trends.

Snapshot of Major Industry Players, 2022

Source: Compiled by Uzabase based on company filings

Toyota and Volkswagen were the market leaders in terms of units sold, with GM following closely. In revenue, Volkswagen held the top position, trailed by Toyota. While most major players generate their revenue from overseas markets, Ford and GM concentrate primarily on their domestic markets. Most players emphasise passenger cars, but Ford distinguishes itself by prioritising the production of heavy and medium trucks for its domestic market.

Additionally, there is a noticeable industry-wide shift towards the production of electric and autonomous vehicles to align with the evolving CASE trends. (Source: Automobiles Industry Overview – SPEEDA Industry Report – World)

The full report in Speeda provides an overview of the Vietnamese automobile industry, with a particular focus on market trends and competitive trends.

Full Report Overview: Automobile Industry in Vietnam

Salient Features

- Vietnam’s automobile industry is in the late embryonic-early growth stage. Its production and sales volume are much lower compared to other ASEAN-6 countries, especially Thailand and Indonesia.

- There are few incentives for the auxiliary industries to develop because the industry’s output is low and collaboration between manufacturers and suppliers is lacking. Toyota Vietnam estimates that a car model needs to sell at least 50,000 units per annum to rationalise investment in local production facilities of parts and components. The best-selling car model in Vietnam, Toyota Vios, sold only 23,259 units in 2022.

- The industry has a low localisation rate (7-10%) compared to Thailand (84%), Malaysia (80%), and Indonesia (75%). As a result, manufacturers rely heavily on imported components and parts, making the cost of production 10-20% higher than that in Thailand and Indonesia.

Value Chain/Business Model

- The industry comprises foreign and local players. Foreign players hold significantly more market power and are more integrated compared to their local counterparts, participating in both the upstream and downstream activities.

- Tier-1 suppliers in Vietnam are largely foreign. Foreign suppliers tend to supply parts to foreign automobile manufacturers exclusively, and local suppliers tend to supply parts only to local manufacturers.

- Local companies typically engage only in the assembling stage, which is low value-adding.

Other Points

- The ATIGA free trade agreement signed in 2009 changed the automobile industry in Vietnam. ATIGA reduced the tariffs on imported automobiles manufactured in ASEAN countries to 30% in 2017 and 0% in 2018. Local manufacturers were heavily impacted by ATIGA, as they had to compete against experienced manufacturers from Thailand and Indonesia. Thanks to ATIGA, Thailand and Indonesia overtook Japan and South Korea to become the largest exporters of automobiles into Vietnam.

- The government attempted to counter the effects of ATIGA by establishing stricter registration and testing requirements, lowering tariffs on imported components and parts, and raising the tariffs on used automobiles.

- Among the top 10 best-selling car models in Vietnam, Toyota and Hyundai continuously hold the largest market share. Vinfast is the only local manufacturer that nearly made it to the top five.

Automobile Industry Value Chain in Vietnam

Report Index

- (1) Industry Overview

- Market in Nascent Stage with Low Localisation Rate and Dependent on Imported Materials; Concentrated Industry Faces Competition from Neighbouring Countries

- Industry Participation Limited to Assembling Stage Due to Weak Auxiliary Industries

- ATIGA Reduced Tariffs on Imported Automobiles to Zero; Government Established Measures to Counter the Effects of ATIGA

- (2) Market Trends

- Production and Sales of Automobiles Strongly Recovered in 2022 Post-COVID-19

- Thailand and Indonesia Have Become the Largest Exporters of Automobiles to Vietnam Since 2017

- (3) Competitive Trends

- Consolidated Industry Dominated by Japanese and South Korean Manufacturers

- Toyota Motor Vietnam: Largest Japanese Automobile Manufacturer in Terms of Sales Volume

- Hyundai Thanh Cong Vietnam: Strong Contender of Toyota from South Korea

- Vinfast Trading & Production: World’s First Pure Electric Automobile Manufacturer

Apply for a Trial to access the full report from Speeda