Báo cáo ngành

Iron Ore Mining in Vietnam

Summary

The report provide you a fundamental understanding of hundreds of industries ranging from major to niche sectors, including new tech-focused trends. Reports organized by Asia-focused countries are logically structured to cover key information such as market size, value chain, key regulations, competitive landscape, and more. (Updated: 17 May 2023)

Utilize the industry reports to get a bird’s eye of the industry quickly (covered within 3,000 words), also combining it with our extensive private company database to further understand key players and trends related to the specific industry. The reports focus on below 3 key segments of the industry which assist users with understanding where to focus on for further deep-dive research.

Report Overview – Iron Ore Mining Industry Overview 2023

Salient Nature/Key Features of the Industry

- Vietnam ranked 21st among the world’s top iron ore-producing countries in 2020. However, iron ore production accounts for a small amount of total iron ore reserves due to inefficiencies in extracting operations.

- Iron ore mining companies heavily rely on blast furnace steel manufacturers for consumption, as the export of raw iron ore is prohibited. Due to the scarcity of blast furnace steel manufacturers in Vietnam, these manufacturers hold the upper hand in negotiating with iron ore mining companies. One specific steel manufacturer, Hoa Phat Group, holds the most potent bargaining power.

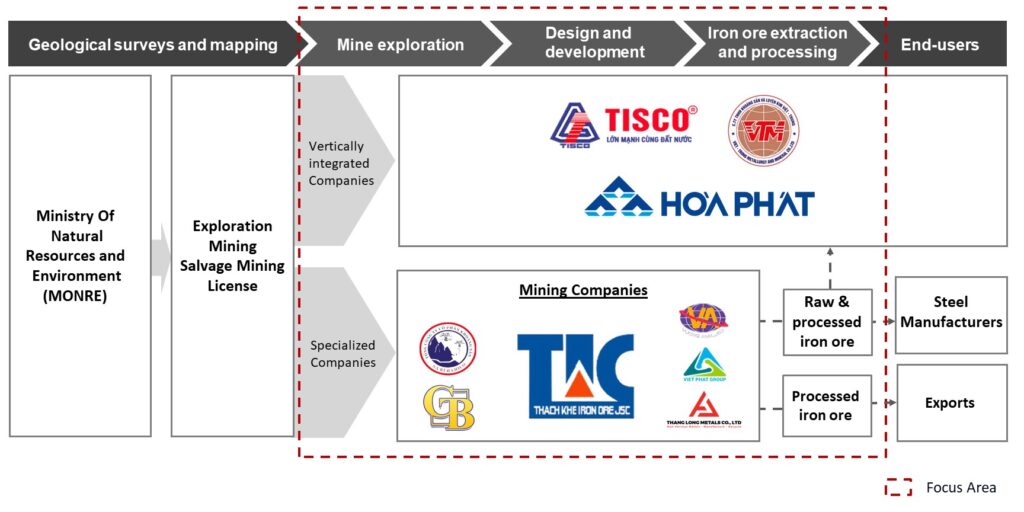

Value Chain/Business Model

- Players are segmented by their business models: vertically integrated vs specialised companies.

- Vertically integrated companies are steel manufacturers that engage in the exploration, mining, and processing of iron ores to self-supply raw materials for their steel production business. A particular case is Hoa Phat Group, which simultaneously self-supplies and purchases iron ores from mining companies due to its significant demand.

- Specialised companies are mining companies that supply raw or processed iron ores to domestic steel manufacturers and export processed iron ores.

Others

- Vietnam’s two largest iron ore mines (Thach Khe and Quy Xa) face several problems hindering their capacity. The government is still deciding whether to shut down the operations at Thach Khe due to environmental concerns. As for Quy Xa, the mine’s capacity is much lower than the government’s expectations.

- Although the government’s initiative is to limit iron ore exports, some mining companies are granted permission to export raw iron ore on a case-by-case basis as they cannot find sufficient demand in the domestic market.

Iron Ore Mining Industry Value Chain

Report Index

Industry Overview

- Limited Iron Ore Production Despite Large Reserve; High Customer Concentration Imposes Price Pressure on Mining Companies

- Large Reserves of Low-Grade Iron Ores; Mines Mainly Concentrated in the Northern Midlands and Mountainous Regions

- Strong Growth Potential Hindered by Geographical Conditions and Lack of Utilisation

- Vertically Integrated Companies Achieve Raw Materials Autonomy; Specialised Companies Supply Iron Ore to Steelmakers

Market Trends

- Iron Ore Production Surged Amid Growing Demand and Price Spikes since 2017 but Subsequently Declined During COVID-19

Competitive Trends

- Consolidated Industry with Few Leading Mining Companies; High Customer Concentration Benefits Hoa Phat Group but Adversely Impacts Specialised Mining Companies

- Hoa Phat Group: Dominating Consumer of Domestic Iron Ore

- Viet Trung Mining and Metallurgy: Primary Source of Iron Ore Supply

- Thach Khe Iron Ore: Mining Licensee of the Largest Iron Ore in Vietnam