Trung tâm tài nguyên

Guide | Discounted Cash Flow (DCF) Valuation

Summary

The DCF method, crucial for assessing investment value by accounting for the time value of money, is vital yet challenging due to its complexity. From predicting future earnings accurately to choosing the right discount rate, the stakes are high, and the errors costly.

A Simplified Guide Towards Company or Project Valuation

Among the myriad of valuation methods, Discounted Cash Flow (DCF) valuation emerges as one of the most popular and fundamental methods, known for its ability to determine the intrinsic value of an investment by considering the time value of money.

In this article, we will go through the overview of DCF, its usage, and a simplified step-by-step guide on how DCF works. Subsequently, we will cover DCF challenges and limitations, along with how our SPEEDA platform can help with these challenges.

Understanding DCF Valuation

The DCF valuation method is a technique used to assess the value of an investment based on its expected future cash flows. It involves estimating how much money the investment will make in the future and then calculating how much that is worth in today’s dollars. This is done by “discounting” those future earnings back to their present value using a specific rate that reflects the risk of the investment. While useful, this process can be complex, involving accurate predictions of future earnings and choosing the right discount rate to apply.

where:

- CF_1= The cash flow for year one

- CF_2= The cash flow for year two

- CF_n= The cash flow for additional years

- r = The discount rate

The Aim of DCF Valuation

The DCF valuation is used to determine the value of an investment today, making its utility applicable to a company or a project provided it generates regular cashflows. The end goal is to see whether one should acquire a company, buy a security, or proceed with the project. Is a company with a market capitalisation of USD 1 million worth that price based on its fundamental and future performance. The DCF aims to answer that question.

Applying DCF: A Simplified Step-by-Step Guide

Step 1: Project Future Cash Flows

Starting off with free cash flow (FCF), or money left after paying operating expenses and capital expenditures. Before doing that, we also need to make key assumptions such as forecast period, revenue growth, expenses with details below.

Identify the Forecast Period: Determine a suitable forecast period for your analysis, typically 5-10 years, based on the availability and reliability of information.

Estimate Revenue Growth: Use historical financial statements, industry analysis, and market trends to project future revenues.

Estimate Expenses: Forecast future expenses, considering both fixed and variable costs, to arrive at the net operating profit.

Calculate Free Cash Flow (FCF): From the net operating profit, adjust for taxes, changes in working capital, and capital expenditures to calculate the FCF for each year in your forecast period.

An example of Company A’s relevant financials to get to FCF

| Ebit | 10,000 |

| Tax Rate | 20% |

| Tax Payment | 2,000 |

| Depreciation | 200 |

| Amortisation | 300 |

| Capital Expenditure (CapEx) | 2,000 |

| Non-Cash Working Capital | 300 |

| FCF | 10,800 |

Step 2: Determine the Discount Rate

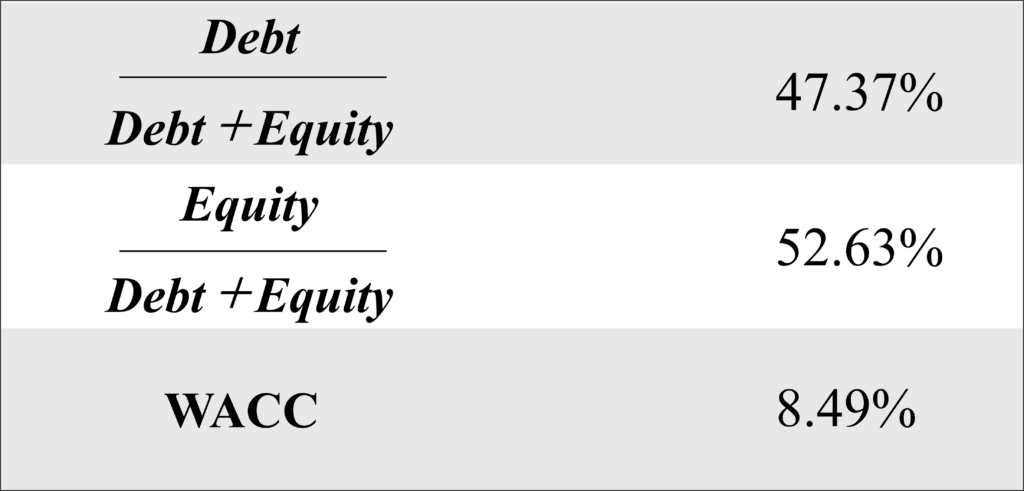

Select a Discount Rate: The discount rate reflects the investment’s risk and the time value of money. For companies, this is often the Weighted Average Cost of Capital (WACC).

| Equity | 50,000 |

| Debt | 45,000 |

| Cost of Debt | 5% |

| Tax rate | 25% |

| Risk Free Rate | 1.5% |

| Beta | 1.3 |

| Market Return | 10% |

| Cost of Equity | 12.55% |

After the calculation of Cost of Equity, we move on to calculate WACC via the CAPM method to get the discount rate.

Step 3: Calculate Terminal Value

In DCF valuation, it’s common practice to forecast cash flows for a period of five years ahead. Beyond this timeframe, predicting a company’s performance becomes less accurate. To address this, a terminal value is employed. To calculate the terminal value, two prevalent approaches are used below. In this article, we will average the two methods.

- Exit Multiple Method: This approach assumes that the business will be sold at a certain multiple of the last forecasted year’s EBITDA.

- Perpetual Growth Method: This method assumes the business will continue to grow at a stable, fixed rate indefinitely.

First, we calculate current and future EBITDA and FCF

| Period | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| EBITDA | 10,500 | 10,920 | 11,335 | 11,743 | 12,142 |

| FCF | 4,624 | 4,956 | 5,381 | 5,639 | 5,842 |

Next, we calculate the Terminal Value using an average of both the Exit Multiple Method (assuming the multiple is 8x) and the Perpetuity Growth (3%)

| EBITDA (last forecast period) | 12,142 |

| Exit Multiple (EV/EBITDA) | 97,138 |

| Perpetuity Growth | 106,405 |

| Average between Exit Multiple and Perpetuity Growth | 101,772 |

Step 4: Calculate Enterprise Value

With the WACC and the Terminal Value ready, we now discount the FCF and the Terminal Value. The discounted figures then get added up to be the Enterprise Value (EV), which is the value of the business.

Discounting the FCF and Terminal Value

| Period | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| FCF | 4,624 | 4,956 | 5,381 | 5,638 | 5,842 |

| Terminal Value | 106,405 | ||||

| Discount Factor | 0.92 | 0.85 | 0.79 | 0.72 | 0.67 |

| PV of FCF | 4,266 | 4,219 | 4,226 | 4,087 | 3,906 |

| PV of Terminal Value | 71,152 |

Now the enterprise value is simply the sum of PV of FCF and Terminal value, which is 91,857.

The Challenges of DCF Valuation

Forecasting Future Cash Flows: One of the most significant challenges in DCF valuation is accurately forecasting future cash flows. This process involves making assumptions about future revenue growth, profit margins, working capital requirements, and capital expenditures. Small changes in these assumptions can lead to significant variations in the valuation.

Determining the Appropriate Discount Rate: The discount rate reflects the risk associated with the future cash flows. Calculating the WACC, which is often used as the discount rate, involves estimating the cost of equity and the cost of debt, each of which comes with its own set of assumptions and challenges. Misestimating the discount rate can lead to a significant overvaluation or undervaluation.

Estimating Terminal Value: A large portion of a company’s valuation in a DCF model often comes from the terminal value, which represents the value of the company beyond the explicit forecast period. The choice of method (e.g., perpetuity growth model or exit multiple method) and the assumptions used (e.g., long-term growth rate) can have a profound impact on the valuation outcome.

Market Conditions and Economic Environment: Changes in market conditions or the economic environment can render DCF valuations quickly outdated. Interest rates, for instance, directly affect the discount rate and can change the valuation significantly. Similarly, economic downturns or upturns can impact the company’s performance projections.

Complexity and Time Consumption: Performing a DCF analysis requires a deep understanding of finance and accounting, along with access to detailed financial information about the company. It can be a time-consuming process that involves complex calculations, making it challenging for those without the necessary expertise or resources.

Ignoring Non-Financial Factors: The DCF model focuses primarily on financial performance and does not directly account for non-financial factors such as brand value, customer loyalty, or market positioning. These intangible assets can be significant drivers of value for some companies.

SPEEDA as Your Go-To Software for Valuation Workflow for Both Buy and Sell-Side

When it comes to conducting valuations as a routine part of your job, having the right tools can make all the difference. They not only save time but also enhance the accuracy and comprehensiveness of your analyses. This is where SPEEDA comes in – a tool designed with a focus on the Southeast Asian market. It offers access to a vast database featuring millions of standardised profiles for both private and public companies.

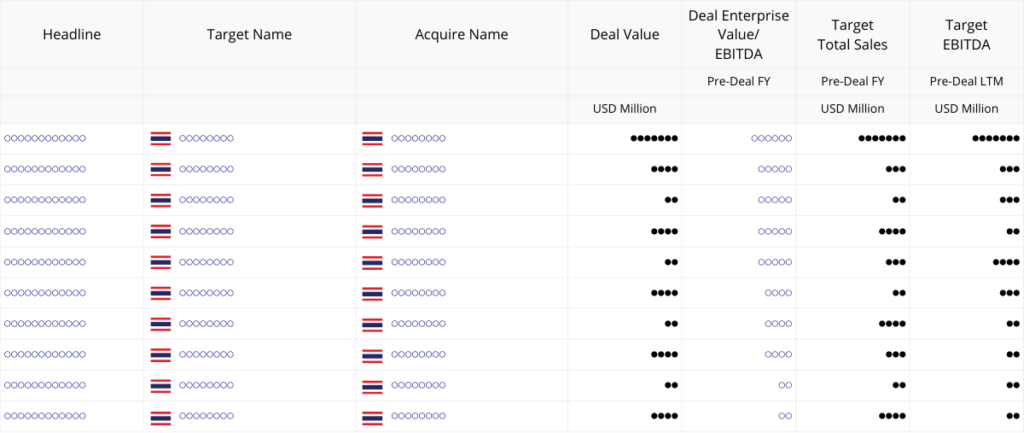

Beyond simplifying the process of company valuation, SPEEDA stands out for its extensive coverage of mergers and acquisitions (M&A). This feature enables users to swiftly examine critical details and metrics related to deals and valuations. Whether you’re analysing market trends, evaluating investment opportunities, or conducting due diligence, SPEEDA streamlines these processes, making it an invaluable resource in your financial toolkit.

How SPEEDA Serves Our Users in M&A Advisory and Banks

Access to Comprehensive Financial Data: SPEEDA helps users save valuable resources with comprehensive financial data, analytical tools, and market insights. The platform is known for its wide private and public company coverage in Southeast Asia with companies mapped to over hundreds of industries by in-house analysts and algorithms, allowing users to quickly retrieve financials, valuation, and comparable metrics across relevant private and public players.

Market Conditions and Economic Environment: The DCF model focuses primarily on financial performance and does not directly account for non-financial factors such as brand value, customer loyalty, or market positioning. These intangible assets, addressed via our proprietary industry and trends reports, can be significant drivers of value for some companies.

The All-in-one Platform to Accelerate Your Valuation and Research Needs in Southeast Asia

Sign Up for a free trial for SPEEDA – your comprehensive solution for enhancing valuation and research across Southeast Asia. With its robust database tailored for both public and private companies, alongside in-house reports on industry trends and M&A data, SPEEDA equips firms in need of robust valuation data with the tools needed for precise target screening, valuation, and market analysis. Benefit from customised research services, access to an expert network through Flash Opinion, and the latest global news.