Trung tâm tài nguyên

Private Company Valuation: Navigating Precedent Transactions

Summary

Explore the complexities of private company valuation using the Guideline Transaction Method. Learn about key tools and platforms like Speeda that streamline data collection, making M&A and PE deal-making more efficient.

Understanding Private Company Valuation: The Challenges and Tools

One of the key steps in M&A deal-making is the topic of company valuation and this is often fraught with subjectivity and opinions, especially when it comes to private company valuation. In a more open and transparent market, such risks arising from subjectivities can be minimised if we consider that all aspects of the companies have been “priced-in” by the market and reflected in the share pricing, including growth projections and management factors, just to name a few. For a Listed Company valuation, the “invisible hands” are ever-present to guide those undertaking valuation, as long as one is diligent enough to gather the pertinent data and facts. Valuation for listed companies is more data-centric and focuses on the financial performance of those companies. Within the financial services industry, there is a plethora of platforms and databases with very comprehensive and usually high-velocity data to use for a valuation model, with platfor

as such as Bloomberg and Capital IQ being the most popular in this space.

For data on startups, where cash flow is usually non-existent, and valuation is more intrinsically linked to narratives on the business, platforms like Crunchbase and Pitchbook are more popular with Venture Capitalists. Latest data on funding rounds, Founders’ profiles, Number of users and a good view of the ecosystem are among the few crucial data points that can help Venture Capitalists assess the value of the Startup.

For private companies’ deal-making, valuation exercises typically require a more tedious and creative approach. For both Private Equity Fund Associates and M&A Advisors, building the financial model and projections for a target necessitates not only a complete and holistic view of the target business, but also a good understanding of the target’s business landscape, including comparable companies, industry growth potential, Supply chain and other factors which the business is contingent upon. Finding data on private companies is more challenging and there are few specialised platforms and databases in the market.

Streamline Data for Asian Private Company Valuation

Speeda is one such Company and Industry data platform that addresses some gaps in the market with comprehensive population data of private companies in major Asian countries. While the prerequisite data and content can be found, if one knows exactly where to look, using a platform like Speeda can potentially save a tremendous amount of time when trying, especially when you are at the initial stage of deal sourcing and valuation.

Here, we will briefly touch on one of the Market Approaches for Private Company valuation.

Valuation: Guideline Transaction Method

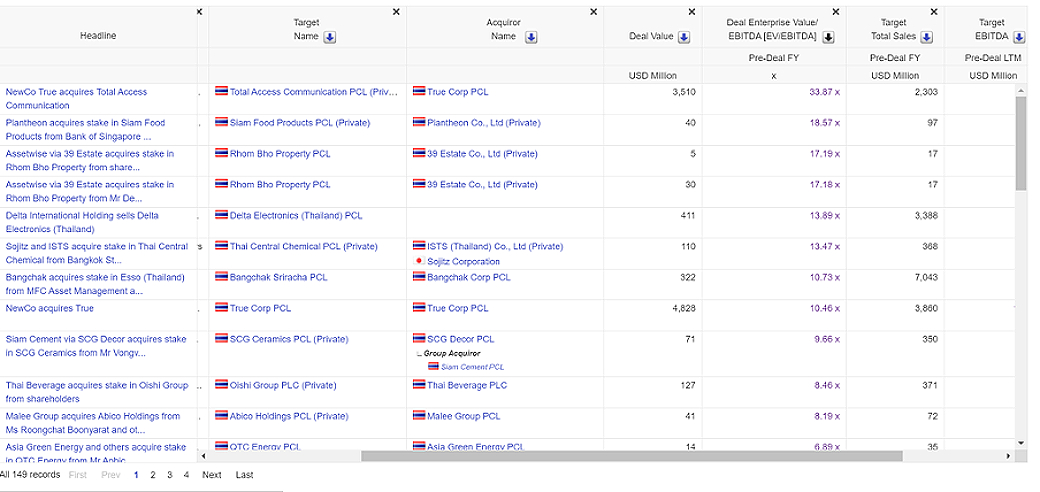

A database like Speeda will include data of precedent M&A deals that can be filtered based on country (of target companies), industries to which it belongs to, deal and financing structure types and revenue size (of target companies). For all private companies on Speeda, a user can use either the local Standard Industry Classification, Speeda’s proprietary industry classification or the NAICS.

- (1) Industry classifications – Otherwise, keyword search option is available on SPEEDA to narrow down to products and services keywords e.g. “drones” OR “unmanned aerial vehicle”

- (2) Deal type – e.g. acquisitions, mergers, MBOs etc.

- (3) Country or Region filter

- (4) Deal completed period – e.g. deals in the last 6 months OR last 10 years

- (5) Target “size” – e.g. comparable net assets.

If the deal value is disclosed for a set of comparable transactions, the calculated Last Twelve Months (“LTM”) EV/EBITDA or EV/Total Sales can be downloaded to serve as the underlying data for the Guideline Transaction Method GTM analysis. From here, you can narrow down further to get the interquartile range for the deal multiples.

Extracting Precedent Transaction Table from a database such as Speeda

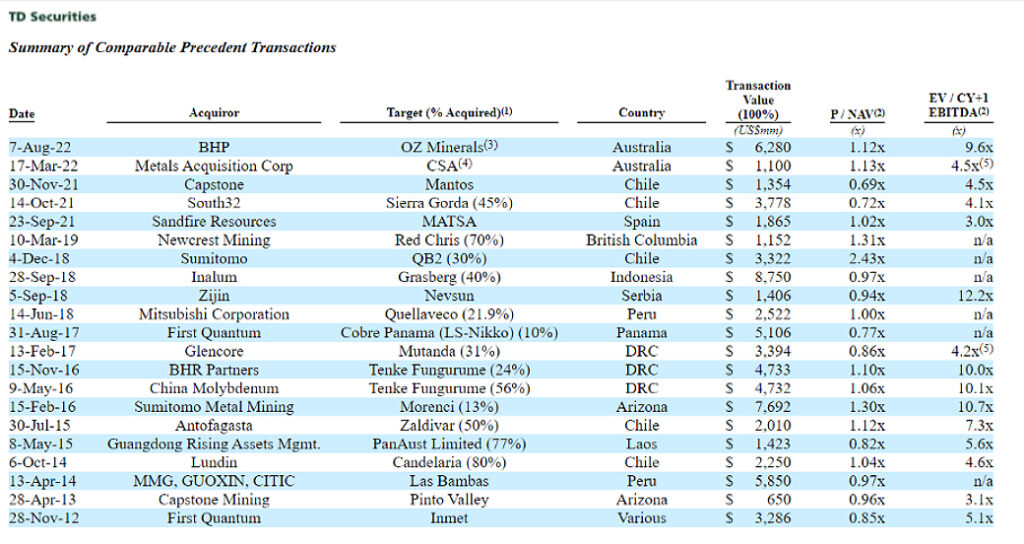

Example of Precedent Transaction Analysis in SEC Fairness Opinion Report

From here, you can back-calculate using the median and interquartile multiple values to get the target company’s and Implied EV and Implied share price, especially if the LTM financial data of your target company is already in a platform like Speeda. Note that for private companies, LTM usually means financial data from the latest Financial Year.

Enhance Deal Understanding in M&A Valuations

Now will also be a good time to gather additional facts on each of the deals in your Precedent Transaction analysis table, to factor in different sets of operating circumstances, financial considerations, off-balance sheet activities, and risk factors, among others. These information are often available within platforms like Bloomberg, Capital IQ and Speeda; For Speeda, some of these information are compiled into the company profile of the target, including LTM business news, and historical financial data. Consequently, you will have enough information to refine your Precedent Transaction analysis further, if needed.

It is also possible to gather the necessary data from open sources and tabulate the data if you do not have access to a platform. However, it is generally not recommended especially if you need to do valuation as a core part of your job scope.

Master the Guideline Transaction Method with a Robust Database

The Guideline Transaction method is one of the eight methods for target company valuation. With access to the right resources, the Guideline Transaction method is one of the most convenient and quicker valuation methods at your disposal, especially for private company valuation. Compared to the Discounted Cash Flow, which requires forward-looking data or Comparable Company analysis which requires calculation of the Control Premium and Size Premium. Regardless, you will need to construct the Football Field Valuation Matrix of your target company and leveraging a good database like Speeda will certainly make the process more efficient and rewarding.