Industry Reports

Consumer Finance Industry in ASEAN

Summary

Explore the diverse landscape of Southeast Asia’s consumer finance industry by region, its evolution, challenges, and the rising impact of P2P lending. (Updated: 7 Dec 2023)

Consumer finance, fundamentally focused on the credit transactions of lending directly with individual customers, primarily includes the short-term, high-cost credit market, essential for helping individuals and households manage their finances. The scope of the industry varies across regions, with some countries having clear distinct definitions for the industry.

This report focuses specifically on short-term, high-cost credit, which is also known as payday loans, high-cost short-term credit, or small-amount credit contracts. Providing a concise overview of the industry and global trends, we aim to present the market dynamics in key Southeast Asian regions.

Global Market Overview

The industry comprises both banks and non-bank entities. Banks, the traditional lenders, adhere to strict credit requirements, often limiting access for non-prime borrowers. In contrast, non-bank entities, such as specialised lenders, focus on short-term credit solutions, catering to underserved segments. These entities generally charge higher interest rates to compensate for the increased risk due to the lack of collateral and lower credit scores of their clients, which could potentially lead to debt traps for borrowers.

According to Enova International, the key growth drivers for the global consumer financial market include global population growth and stagnant household incomes among the working class. Additionally, evolving consumer spending habits, particularly on consumer durables and lifestyle changes, are influencing the industry as well.

To protect borrowers, regions with a clearer market scope have introduced stricter regulations, including limits on unfair lending practices and interest rate and fee caps for consumer protection

Consumer Finance Industry in ASEAN

The consumer finance industry across the ASEAN region is characterised by its notable diversity, reflecting the distinct economic developments and varied banking landscapes unique to each country.

In developed nations like Singapore, where the banking population is high, there’s a noticeable decline in the demand for personal loans, leading to reduced borrowing activities. On the other hand, emerging countries such as Malaysia, Thailand, and Vietnam are experiencing a surge in the demand for short-term credit. This trend is largely driven by a significant unbanked population and increasing household indebtedness.

Here is the overview of these key ASEAN markets, delving into the specific dynamics and trends shaping the consumer finance industry in each region.

Singapore

Singapore

Market Overview: Low Borrowing and Declining Loan Demand

Singapore’s consumer finance market is characterised by a relatively low level of borrowing activity. Trading Economics reports that Singapore’s total household debt as a proportion of its Gross Domestic Product (GDP) is significantly lower compared to other ASEAN countries, likely reflecting the risk-averse nature prevalent in Singaporean culture. Those who do opt for loans generally prefer formal financial institutions over informal sources.

In 2022, an increase in interest rates led to higher borrowing costs, resulting in a noticeable decline in the demand for personal loans. This period also saw a shift away from formal financial sources, indicating a reduction in the number of individuals seeking loans from financial institutions.

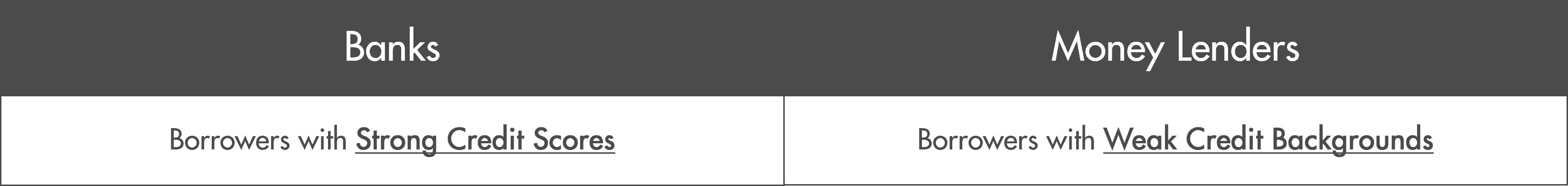

Competitive Landscape: Banks and Moneylenders Dominates the Market

In Singapore, consumer finance services are primarily provided by banks and moneylenders. Traditional banks adhere to strict credit requirements for unsecured loans, whereas moneylenders offer a range of unsecured loans (like education, travel, and medical loans) to those with limited creditworthiness. The market boasts 154 licensed moneylenders as of May 2023.

Consumer Finance Industry Players in Singapore

Industry Players in Singapore

The Monetary Authority of Singapore (MAS) enforces stringent lending regulations, particularly for moneylenders, requiring a licence under the Moneylenders Act. The Ministry of Law lists licensed moneylenders, and since 2011, advertising regulations have limited moneylenders to advertising in specific directories and their own premises.

Peer-to-peer (P2P) lenders, providing faster and often more cost-effective personal loans, are emerging as significant competitors to traditional banks and moneylenders, reshaping Singapore’s lending landscape. More on the impact of P2P lending is discussed in the Emerging Trends section.

Thailand

Thailand

Market Overview: High Underbanked Population and Preference for Non-Bank Loans

Despite having one of the highest banked populations in ASEAN-6, Thailand faces a unique challenge with almost half of its population being ‘underbanked.’ A significant factor contributing to this situation is the reliance of many adults on remittances as their main source of income. While non-bank entities are restricted from accepting deposits, these remittance transactions are primarily handled by commercial banks.

Many individuals in Thailand choose alternative financial services provided by non-banks or other sources. This trend is particularly noticeable among low-income earners or those without a steady income, who often find it challenging to secure loans from commercial banks due to stringent lending processes. Non-banks, with their extensive reach in provincial regions, offer greater accessibility to these populations, reflecting a strong preference for non-bank loan products.

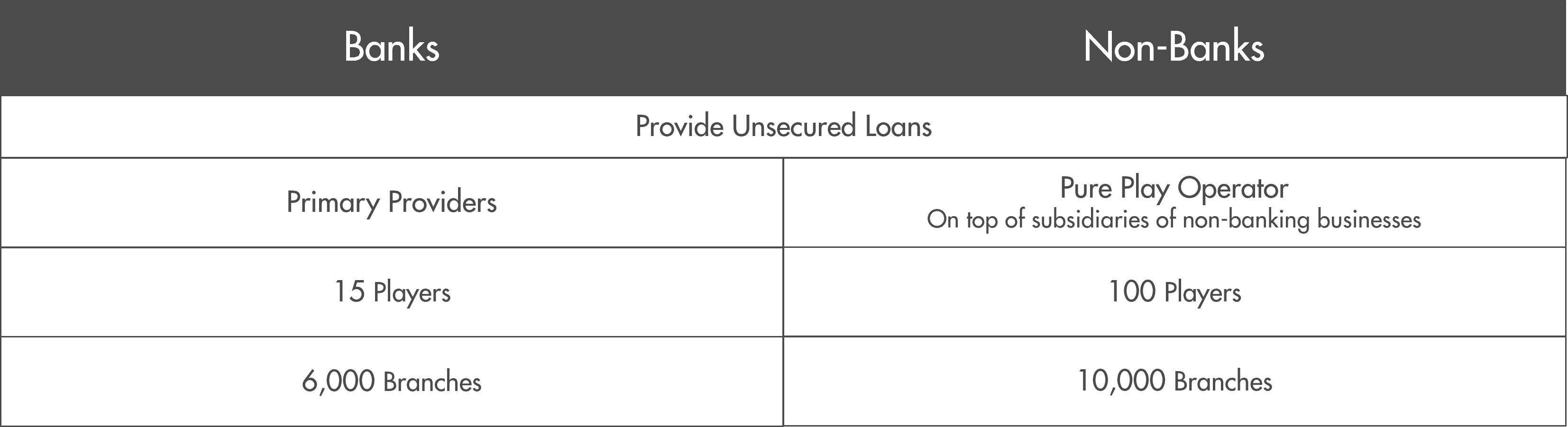

Competitive Landscape: Non-Banks and Banks Serving the Underbanked

Thailand’s consumer finance industry includes over 100 non-bank entities and around 15 banks offering unsecured loans. As of 2019, non-banks have established a significant presence, boasting nearly 10,000 branches which cater to the ‘underbanked’ demographic. Banks offer unsecured loans directly or via subsidiaries for specific products. While non-banks include both pure play operators and subsidiaries of other non-banking businesses, relying on equity and debt for loan funding, as they cannot accept deposits.

Consumer Finance Industry Players in Thailand

Industry Players in Thailand

The country’s uniqueness is it offers a wide array of consumer finance products with a focus on the underbanked and informal loan sectors. Key products include credit cards, term loans, revolving credit, emerging digital personal loans, and nano finance available through both banks and non-banks.

These innovative loan types are seen as potential solutions to combat the prevalence of informal loans and the region is now shifting towards digital personal loans and nano finance.

Nano finance aims to promote financial access by offering multipurpose loans for business, or personal consumption. Digital personal loans cater to individuals without regular or verifiable income and those lacking collateral. These innovative loan types, less stringent in approval, address informal debt issues and are suitable for those with unstable income, are expected to pave the way for future financial services.

Malaysia

Malaysia

Market Overview: High Household Indebtedness and Underbanked Population

Malaysia, much like Thailand, boasts a high banking population. However, as per a Kapronasia report, 55% of Malaysian adults fall under the category of ‘underbanked’. This segment predominantly includes low-income individuals who face limited access to conventional financial services.

Compared to its regional counterparts, the country also stands out for its relatively high levels of household indebtedness. Given this indebtedness and the significant underbanked population, illegal money lending has become a prevalent issue in Malaysia.

In 2019, the Ministry of Housing and Local Government (KPKT), responsible for regulation and governance, initiated a rebranding of the ‘licensed moneylenders’ to ‘community credit providers’ to enhance consumer awareness. This description more accurately reflected their role in offering low-amount loans with capped interest rates, specifically targeting the low-income segment.

Competitive Landscape: Diverse Providers Serving Various Income Groups

The consumer finance industry in Malaysia comprises banks, non-bank financial institutions, and community credit providers.

While banks and non-bank financial institutions are highly regulated and typically enforce stringent lending criteria, community credit providers focus on serving the bottom income group with simplified loan application processes, faster approval times, and more flexible, smaller loan amounts.

Consumer Finance Industry Players in Malaysia

Industry Players in Malaysia

In November 2020, KPKT approved online loan operations. One notable example of innovation in the industry is BigPay Later, a pioneer in digital personal lending solutions in the region. After securing a provisional licence from KPKT, BigPay Later launched fully digital loans in March 2022, marking a significant step towards digitalisation in Malaysia’s consumer finance sector.

Vietnam

Vietnam

Market Overview

Vietnam’s consumer finance industry, while relatively underdeveloped compared to other ASEAN countries, shows significant potential for growth. According to the State Bank of Vietnam (SBV), around 70% of Vietnam’s adult population have bank accounts, yet nearly half of them did not have access to credit in 2020.

The substantial market size, coupled with increasing consumer spending and low consumer finance penetration, underscores the sector’s growth prospects. This potential is further enhanced by the active participation of local finance companies and foreign players, evident through multiple mergers and acquisitions (M&A) deals.

Despite the high rate of bank account ownership, formal financial services remain largely inaccessible for most Vietnamese. The World Bank reported that nearly 63% of Vietnamese borrowed from informal lenders in 2019. In response, the Vietnamese government has been promoting consumer finance companies, with official regulations implemented by the State Bank of Vietnam (SBV).

Competitive Landscape

The consumer finance industry in Vietnam consists of commercial banks and finance companies. Finance companies cater to high-risk consumers who typically do not meet the credit requirements of commercial banks.

These companies focus exclusively on unsecured loans, offering a diverse product mix that includes cash loans, vehicle loans, and consumer durable loans. Most finance companies are relatively young, often operating as subsidiaries of commercial banks. Contributing a smaller share to the outstanding loan balance compared to commercial banks, their influence has grown considerably over the past decade.

Consumer Finance Industry Players in Vietnam

Future: P2P Lending Growing Increasingly Popular with Proliferation of Online Lending

In conclusion, Southeast Asia’s consumer finance industry is marked by a dynamic, evolving landscape influenced by diverse regional factors and a blend of traditional and innovative financial services. With growth driven by technological advances, regulatory shifts, and changing consumer behaviour, the industry faces both opportunities and challenges ahead.

One of the emerging technologies making inroads into the online lending market is P2P lending, a platform-based application that allows borrowers to post loan requests for investors to review and fund. These platforms are increasingly preferred due to streamlined processes, suitability for smaller loans, and quicker funding times, appealing to consumers with lower credit scores and small and midsize enterprises (SMEs). The global P2P lending market is forecasted by Precedence Research to expand rapidly, particularly in the Asia-Pacific region, with an estimated CAGR of about 27% from 2023 to 2032, with Singapore leading the Southeast Asian market.

In Speeda, you will be able to find more details about each region’s trend, including the value chain, competitive trends, industry leaders, market size, and growth. Apply for a free trial to access all reports written by our analysts.

Try our free trial to read the full report on the credit card industry and other 3,000 reports written by local analysts. Gain insights for your business and bring more efficiency.