Trend Reports

Unlocking Growth: A Deep Dive into India’s Logistics Potential

Summary

Explore India’s booming logistics sector—driven by e-commerce, FDI, and cold chain growth—poised to hit $546B by 2030.

An Overview of the Evolving India’s Logistics Market

| Logistics is Key to the Entire Product Journey

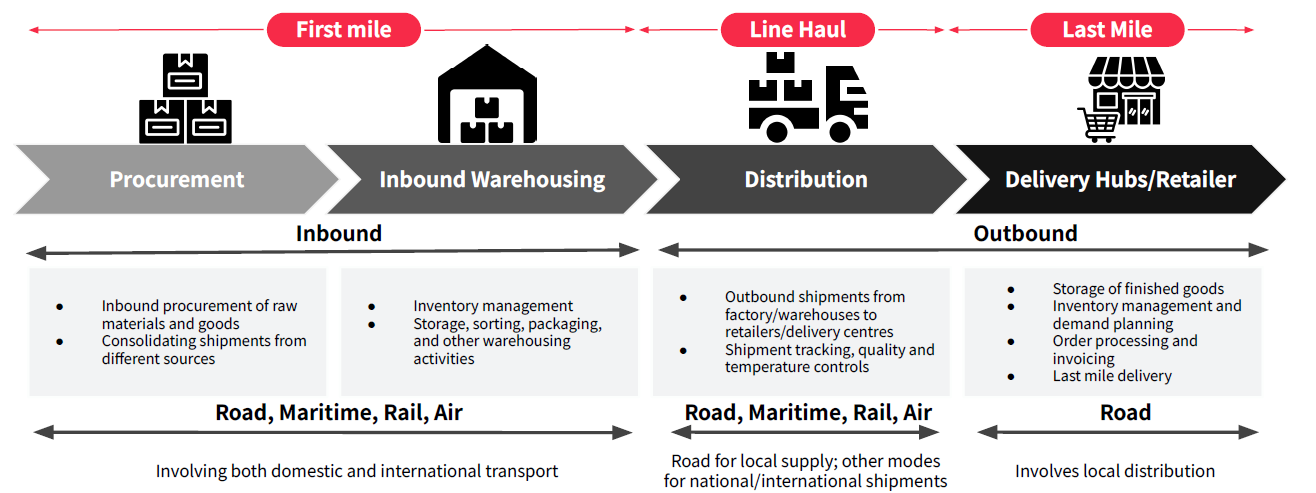

Logistics is the foundational framework managing the complete lifecycle of resource movement, from sourcing raw materials to delivering finished products. The process includes inbound logistics (procurement, consolidation, and warehousing) and outbound logistics (distribution and order fulfilment). This value chain is segmented into the ‘first mile’ (manufacturer to warehouse), ‘line haul’ (between distribution centres), and the ‘last mile’ (local hub to customer). While the first two stages utilise road, maritime, rail, and air, the final mile is dominated by road transport.

The logistics market in India and Southeast Asia is fragmented, featuring a dynamic mix of local and major international players. This diversity is evident across all segments. In freight forwarding, global giants like Maersk, Kuehne+Nagel, and DSV manage the complex orchestration of goods. The critical warehousing and distribution segment is handled by companies such as DHL and India’s own Container Corporation of India (CONCOR). Specialised services are also crucial, particularly in refrigerated warehousing, which is served by companies including Snowman and Lineage. For local distribution, regional powerhouses like VRL Logistics are vital. This multifaceted landscape underscores a competitive industry where providers carve out expertise in specific areas.

Source: KPMG, ʻThe Logistics and Warehousing Market in India

Demand and Supply Factors Fuelling Logistics Growth

| Strong Macroeconomics Propel Market Potential

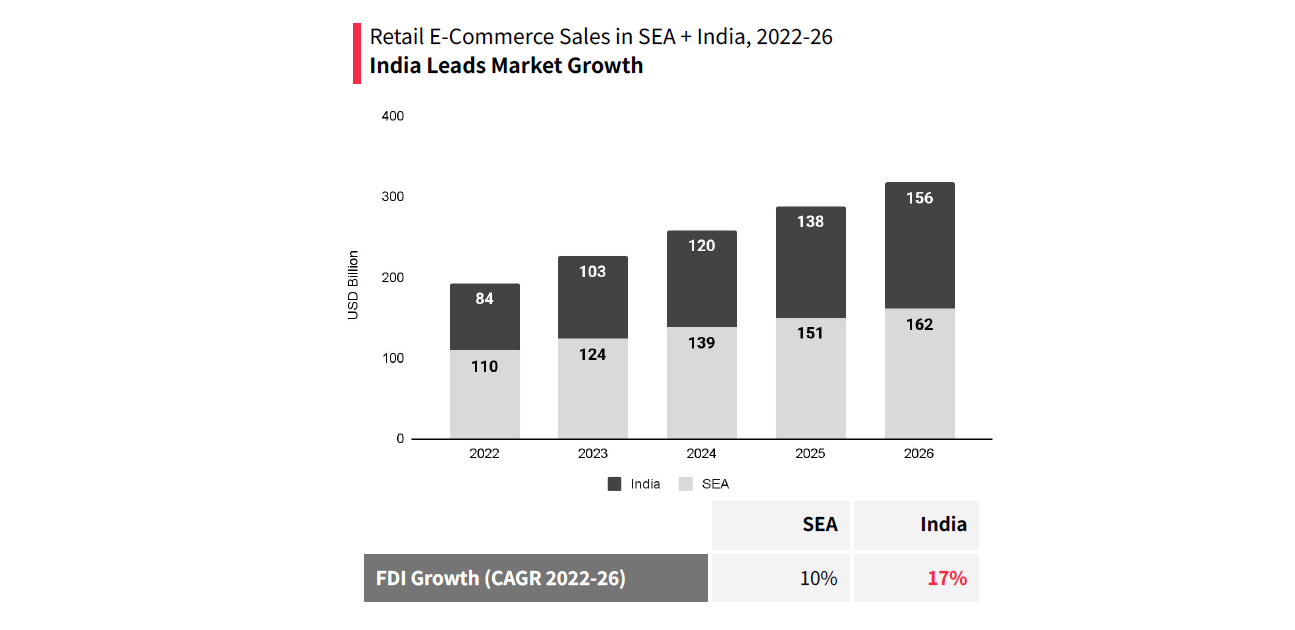

The logistics sector in India and Southeast Asia is on a steep growth trajectory, underpinned by robust macroeconomic fundamentals. The region’s combined market is projected for significant expansion, with India leading in both size and growth rate. The nation’s logistics market is forecast to grow from USD 349 billion in 2025 to USD 546 billion by 2030, a CAGR of 9%. This expansion is fuelled by powerful demand-side factors, primarily a booming e-commerce market supported by a rapidly rising middle class. India’s retail e-commerce sales are projected to grow from USD 84 billion in 2022 to USD 156 billion by 2026. This translates into heightened demand for logistics infrastructure, as e-commerce firms require more space than traditional retailers for their extensive product ranges, larger inventories, and reverse logistics. This trend is accelerated by the region’s demographic shift. In emerging markets, including India, the number of middle-class households is expected to nearly double between 2024 and 2034. This growing consumer base increasingly prefers the convenience of online shopping, creating a virtuous cycle where a larger middle class fuels e-commerce, which in turn demands more sophisticated logistics.

| FDI Inflows and Government Investments Drive the Supply

On the supply side, growth is driven by manufacturing, investment, and government action. A strategic shift in global trade is positioning India as a vital manufacturing hub, directly fuelling demand for advanced warehousing. India’s exports expanded from USD 323 billion in 2019 to USD 431 billion in 2023 and have the potential to reach USD 1 trillion by 2030, signalling a massive future need for logistics support. This growth is attracting significant Foreign Direct Investment (FDI) from firms looking to build resilient global supply chains. In a notable shift, the six largest economies of Southeast Asia attracted more FDI (USD 206 billion) than China (USD 43 billion) in 2023, a trend that reflects growing business confidence across the broader region, including India. This influx of capital is actively supported by substantial government investments aimed at transforming the logistics landscape by improving road infrastructure to enhance connectivity and lower costs. However, public funds alone will be insufficient, creating a significant opportunity for private investors and logistics companies to bridge the gap and build the next generation of infrastructure.

Source: McKinsey & Company, ʻDiversifying global supply chains: Opportunities in Southeast Asia’, JLL, ʻLogistics in Southeast Asia: what’s behind the boom? | Jones Lang LaSalle (JLL), McKinsey, ʻE-commerce is entering a new phase in Southeast Asia. Are logistics players prepared? | Oxford Economics, ʻThe Future of the Middle Class in Emerging Markets

Key Business Opportunities in the Logistics Sector

| India’s Cold Chain Offers High-Growth Investment Potential

Lucrative business opportunities are emerging in specialised areas like cold chain and warehousing. The demand for cold chain logistics is surging due to rising disposable incomes, the growth of online grocery shopping, and a greater need for temperature-sensitive pharmaceuticals. A robust cold chain is essential for India to preserve perishables and support its economic momentum as a global export leader. The Indian cold chain market is forecast to grow from USD 13 billion in 2025 to USD 20 billion by 2030 (a 10% CAGR). Despite this potential, the sector remains underdeveloped, presenting a clear opportunity for new investment and specialised expertise. This has already attracted foreign investors like Mitsui & Co. and Maersk, who are expanding their cold chain operations in the country.

Parallel to this, the demand for modern warehousing is being propelled by the e-commerce boom. The Indian warehousing market is set for remarkable growth, projected to expand from USD 14 billion in 2024 to USD 35 billion by 2029, at an impressive 19% CAGR. This high-growth environment is encouraging global logistics leaders to significantly increase their footprint. For example, Nippon Express recently opened a new warehouse in Bengaluru to serve the quick-commerce industry, while A.P. Moller-Maersk plans to add nearly 480,000 square metres of warehouse capacity across the region by 2026. These trends highlight a clear path for investment in advanced logistics infrastructure.

Source: Mordor Intelligence, Maersk (1), (2), VCCircle

Navigating the Business Challenges Ahead

Despite significant opportunities, the logistics sector in India and the surrounding region presents notable challenges that require strategic navigation. A primary issue is the fragmented and varied quality of infrastructure. While some hubs like Singapore boast world-class infrastructure, there are significant inconsistencies elsewhere. India, for instance, faces challenges with heavy traffic congestion and poor access to rural areas, a consequence of its vast geography. This disparity in infrastructure quality can create logistical complexities and increase operational costs. The region’s strategic location, while a boon for maritime trade with major ports like Jawaharlal Nehru Port and Mundra Port playing key roles, also exposes supply chains to geopolitical tensions. Territorial disputes, such as those in the South China Sea, pose a constant risk to the stability of critical trade routes. An escalation of these conflicts could lead to higher shipping costs, forced route diversions, and severe supply chain disruptions, impacting the seamless flow of global trade.

To mitigate these risks, companies are increasingly turning to advanced technology. The need for real-time tracking and optimised routing has created a significant opportunity for satellite data services to enhance supply chain visibility and resilience. Satellite Automated Information System (AIS) technology, for instance, offers high-frequency position updates for vessels, even in high-traffic zones and complex shipping lanes. This allows companies to monitor shipments in real-time, identify potential maritime hazards, and proactively adjust routes to avoid congested or high-risk areas. Furthermore, this data provides valuable trade intelligence, helping firms anticipate market shifts and manage geopolitical or regulatory risks like port closures and trade restrictions. By leveraging satellite data for enhanced tracking and risk management, logistics firms can build more resilient operations and proactively navigate the inherent challenges of the region.

Source: World Bank, ʻInfrastructure Gaps Vary across East Asia and the Pacific – and between Cities and Rural Areas

Unpack Growth Across India & SEA’s Logistics Boom

Speeda is your go-to platform for Asian business intelligence – offering unrivalled access to over 11 million private company data, over 3,000 expert-written industry reports, and tailored research support to power smarter, faster decisions.

Curious about what’s driving logistics growth in Southeast Asia? Get in touch to unlock the data and analysis available on Speeda. Dive deeper into key sectors, uncover market opportunities, and stay ahead of the curve across Asia’s most dynamic economies.