Trend Reports

Southeast Asia 2024 3Q M&A Quarterly Report

Summary

Explore Southeast Asia’s Q3 2024 M&A trends with insights on major deals, sector analysis, and the rise of startup investments. This article covers:

- Quarterly summary of M&A deal activities

- Industry highlights of 3Q deal trends

- Overview of startup deals of the quarter by country and industry

M&A Scene Heats Up: Bigger Deals, Smarter Plays in Q3

In today’s competitive market, each strategic move counts. Southeast Asia’s M&A landscape is showing fascinating shifts, and Speeda’s latest 3Q24 report keeps you informed on the trends reshaping the region. This report delivers the essential insights financial professionals need to stay ahead of the curve.

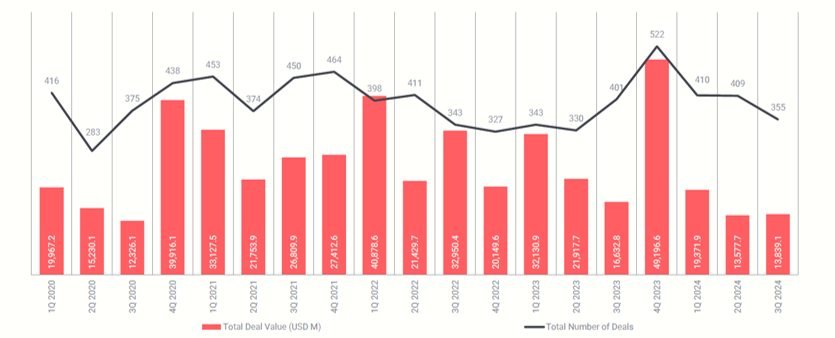

Deals Scale Up as Volumes Dip: Quality Over Quantity

With rising macroeconomic uncertainties, investors are opting for fewer but more substantial deals. This quarter, total deal value reached an impressive USD 13.8 billion, driven by mega deals. The top five deals surged by 65% quarter-over-quarter, even as deal volumes dipped by 13.2%. This trend highlights strong confidence in high-stakes investments.

[Number and Value of Southeast Asia’s M&A Activities | 3Q 2024]

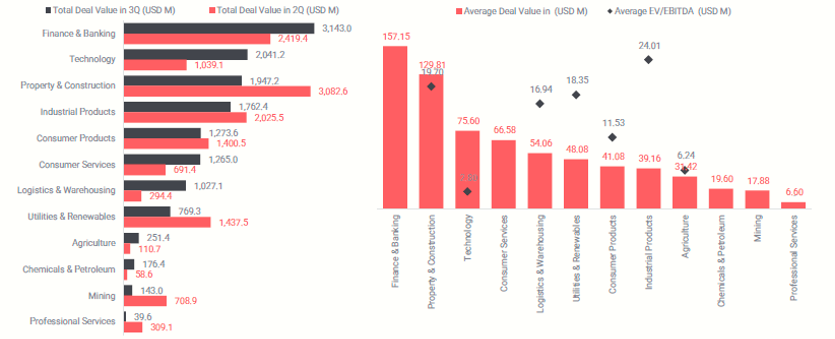

Industry Highlights: Banking & Finance – A Sector to Watch

The finance and banking sectors led M&A activity, topping both total and average deal values, closely followed by real estate and technology. This momentum reflects strong growth expectations, particularly in banking, where high-value transactions indicate significant investor confidence.

[M&A Deals by Industry in Southeast Asia | 3Q2024]

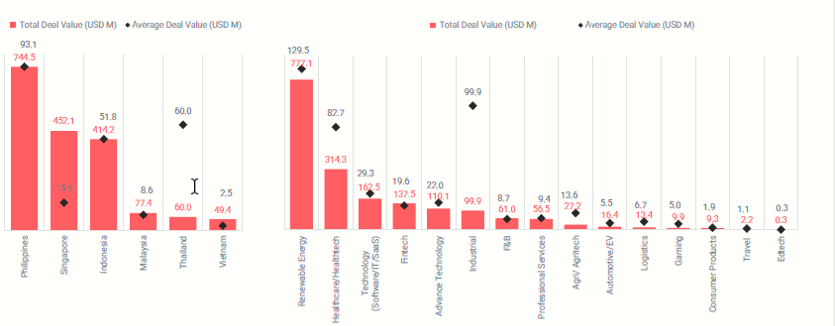

Renewable Energy Sector in the Philippines Leads Startup Deals

Starting this quarter, our report includes an in-depth analysis of startup deals across the region. In 3Q 2024, the Philippines emerged as a significant player, securing USD 744.5 million in startup investments—outpacing Singapore by 1.6 times. The renewable energy sector particularly stood out, led by Terra Solar’s substantial USD 600 million investment, highlighting the rise of sustainable investments in the region.

[Start-up Deals by Country and Industry | 3Q 2024]

Why This Matters for You

In a fast-moving market, having the right insights is crucial. This report not only highlights key data points but provides the stories behind the numbers, offering a clear picture of where Southeast Asia’s M&A market is heading. Speeda’s in-depth analysis, sector breakdowns, and exclusive highlights empower you to make informed, data-driven decisions.

Sign up today to access the full report and dive into Southeast Asia’s M&A landscape including:

- Regional deal activity analysis

- Comprehensive sector-by-sector breakdowns

- Special highlights on the Philippines’ M&A scene

- Top deals and key financial/legal advisors

- Detailed insights on startup investments by country, industry, and funding round

Stay ahead with insights into the trends shaping Southeast Asia’s future M&A landscape.

Terms of Use:

Your personal information will be collected and used to provide newsletters, updates, and messages regarding our products and services.

Privacy Policy:

For detailed information on how we handle personal information, please refer to the following link: Uzabase Privacy Policy

Thank you for your submission!

We will send an email with the download link to access the report shortly.

Follow our Linkedin Page !

Our latest updates on

ASEAN reports and webinars are posted here.