Trend Reports

HK Property Market Outlook 2026: Bottoming Out or Continued Correction?

Review of 2025 Market Performance

Overall Performance of HK’s Private Residential Sales Market

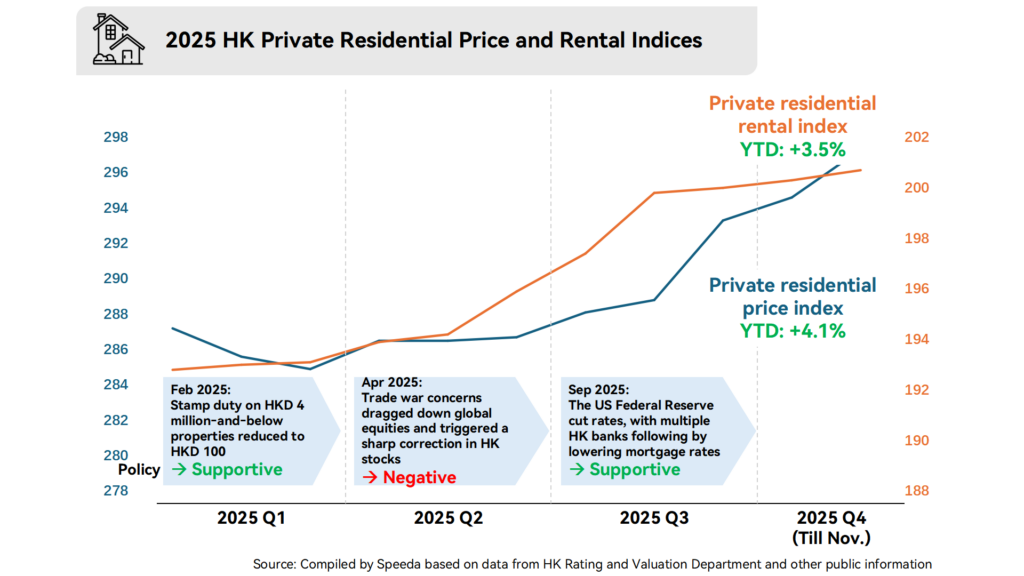

After three consecutive years of correction from 2022 to 2024, HK’s housing market showed signs of bottoming out and stabilizing in 2025. By November 2025, the private residential price index had risen by about 4.1% year‑to‑date. The rebound was mainly driven by two factors:

- Rate cuts and the “rent‑to‑buy” shift: Following the Fed’s rate‑cut cycle that began in late 2024, major HK banks lowered their prime rates. For example, HSBC’s prime rate fell from a 2024 peak of 5.625% to 5.00% by October 2025, close to 2019 levels. As financing costs declined while the rental index remained elevated, rental yields on some properties began to exceed mortgage rates, encouraging some tenants to switch from renting to buying and drawing yield‑seeking investors back into the market.

- Mainland capital as the key buying force: Since 2023, a series of property‑market easing measures (such as the removal of additional stamp duties and new residential stamp duties) have continued to take effect. In particular, cutting stamp duty on units priced at HKD 4 million or below to HKD 100 significantly reduced transaction costs. The data indicate that mainland capital has become a crucial source of liquidity underpinning the recovery in transaction volumes.

Overall Performance of HK’s Private Residential Leasing Market

The residential leasing market has continued on the upward trajectory it has been on since 2023, repeatedly reaching new highs. As of Nov. 2025, the rental index had risen by nearly 3.5% year‑to‑date, reaching 200.7, a historic peak. The key factors underpinning the elevated rental levels include:

- Rigid leasing demand driven by talent admission schemes: Since the government launched its talent admission policies at the end of 2022, they have delivered significant results, bringing in more than 230,000 high‑calibre professionals to HKso far. This increase in the population structure has directly translated into leasing demand and is consistent with the strengthening rental uptrend that began in 2023.

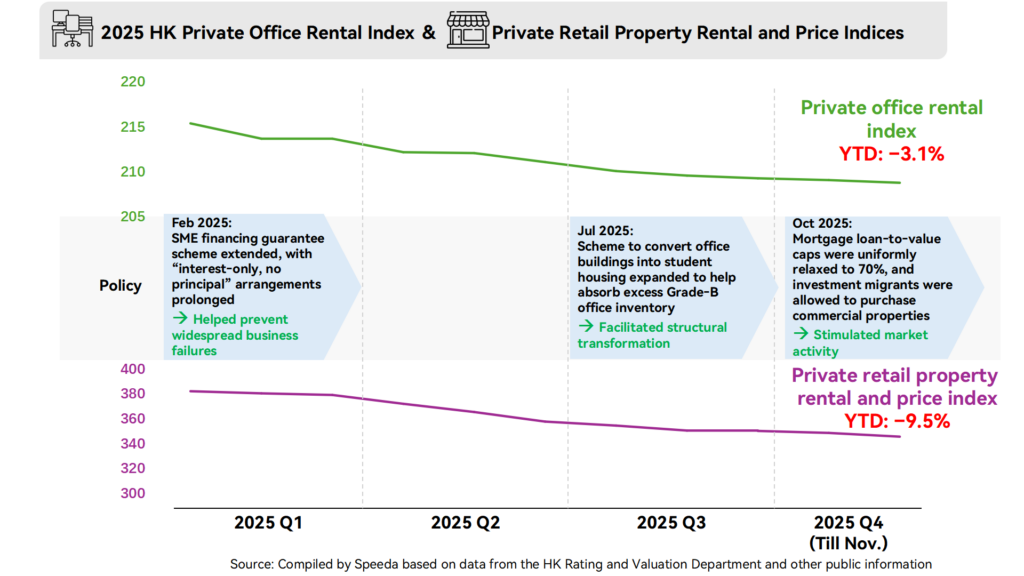

Overall Performance of HK’s Office and Retail Property Markets

The commercial property market remains in a period of deep adjustment. As of Nov. 2025, the private office rental index and the retail property rental and price indices had fallen by 3.1% and 9.5% year on year respectively, but these declines were narrower than in 2024, when they dropped by 4.2% and 17.4% respectively.

- Office market: oversupply and structural vacancies coexist. Although the government has introduced policies such as converting office buildings into student hostels to digest the stock of Grade B offices, such supply‑side reforms take time and are unlikely to quickly restore supply–demand balance. The key challenge is that 2025–2026 marks a peak period for new Grade A office completions, pushing up the overall vacancy rate, while the normalisation of work‑from‑home (WFH) practices has dampened corporates’ expansion plans. As a result, rents are hovering at low levels, with bargaining power tilted in favour of tenants.

- Retail market: outbound consumption suppresses rental rebound. The performance of retail properties is constrained by structural changes in consumption patterns. Although the number of inbound visitors has rebounded after the reopening post‑pandemic, the normalisation of HK residents spending across the border in the Mainland has led to a significant outflow of local consumption power. In addition, faced with high operating costs, retailers remain very cautious when renewing leases or expanding. The current market adjustment reflects retail rents retreating from previously high premium levels to more rational levels that better align with actual sales performance.

2026 Market Outlook

Although the performance of the private residential market in 2025 has restored a certain degree of confidence among investors, it is still too early to conclude that the housing market has fully entered a “bull market.” Looking ahead to 2026, market trends will no longer be driven by interest rates alone, but will instead hinge on the pace of inventory digestion and the validation of real purchasing power.

- Pressure from destocking in the residential market limits the extent of price rebounds: Despite the improvement in market sentiment, the high level of inventory remains a hard ceiling on any substantial surge in housing prices. According to data from the Housing Bureau, the potential supply of first‑hand private residential units in the coming three to four years will remain at a high level of around 100,000 units. In the face of this accumulated inventory, developers’ primary strategy has shifted from pursuing high premiums to focusing on turnover and cash flow.

- Validation of talent retention and the sustainability of easing policies: The market’s focus will shift from the headline number of incoming talent to the quality of retention. The key lies in whether HK’s labour market can offer sufficient job vacancies to support these talents in renewing their stays, which will directly determine whether leasing demand can be converted into long‑term purchasing power for homeownership. In 2026, the market will closely watch whether the government maintains the current low‑tax environment and its stance on cross‑border capital flows, as these will directly influence the willingness of Mainland funds to continue entering the market.

- Peak supply and structural reshaping in commercial real estate: The commercial property market is entering a phase of inventory digestion and business model restructuring. On the office side, as large landmark projects in Central and non‑core districts are completed one after another, the market is undergoing a deep process of inventory absorption. Rental trends are expected to become increasingly polarised, with shops that focus on experiential consumption or essential daily‑needs demand likely to stabilise, while traditional locations that lack competitiveness will continue to face structural adjustment.

Commercial Implications

HK’s record‑high residential rents and the ongoing adjustment in the commercial property sector create a landscape where structural opportunities and cost pressures coexist for international capital and enterprises, requiring differentiated strategies by business model and timely use of the current window period.

For institutional investors planning to allocate to HK assets through direct property holdings or real estate funds, it is important to note that the residential market will likely remain in a destocking cycle over the next three to four years, and primary market pricing strategies will cap the upside in home prices, leaving limited room for short‑term capital gains. However, against the backdrop of falling interest rates and potentially narrowing rate differentials with other countries (such as Japan) that may raise rates, HK assets offering stable rental yields and a positive carry (for example, converted student accommodation) could become more attractive.

In addition, as some local developers face pressure to recycle capital, companies with ample cash flow can watch for opportunities to acquire quality assets at below replacement cost through joint ventures or acquisitions. During the 2022 housing market downturn, rental housing brand Weave Living partnered with foreign funds (Angelo Gordon, PGIM) to invest against the cycle, focusing on acquiring hotel and residential assets in West Kowloon (desirable school network districts) and the Mid‑Levels (professional communities) and converting them into counter‑cyclical long‑stay apartments. According to its management, this strategy successfully locked in stable rental returns with room for further rental growth.

Meanwhile, Grade‑A offices and certain retail properties continue to be affected by high vacancy rates and downward pressure on rents, but the rising vacancy of prime core assets and the greater pricing flexibility of landlords objectively create conditions for long‑term capital to enter at more reasonable yields. At the same time, investors need to carefully assess tenant quality and lease tenors to mitigate the risk of income volatility.

Editor:Curtis So, Speeda Analyst