Trend Reports

Download Report | Southeast Asia M&A 1Q25 Insights and Sector Highlights

Indonesia’s SOE Restructuring Spurs Record M&A Value

| Restructuring Strategy for State-Owned Enterprises

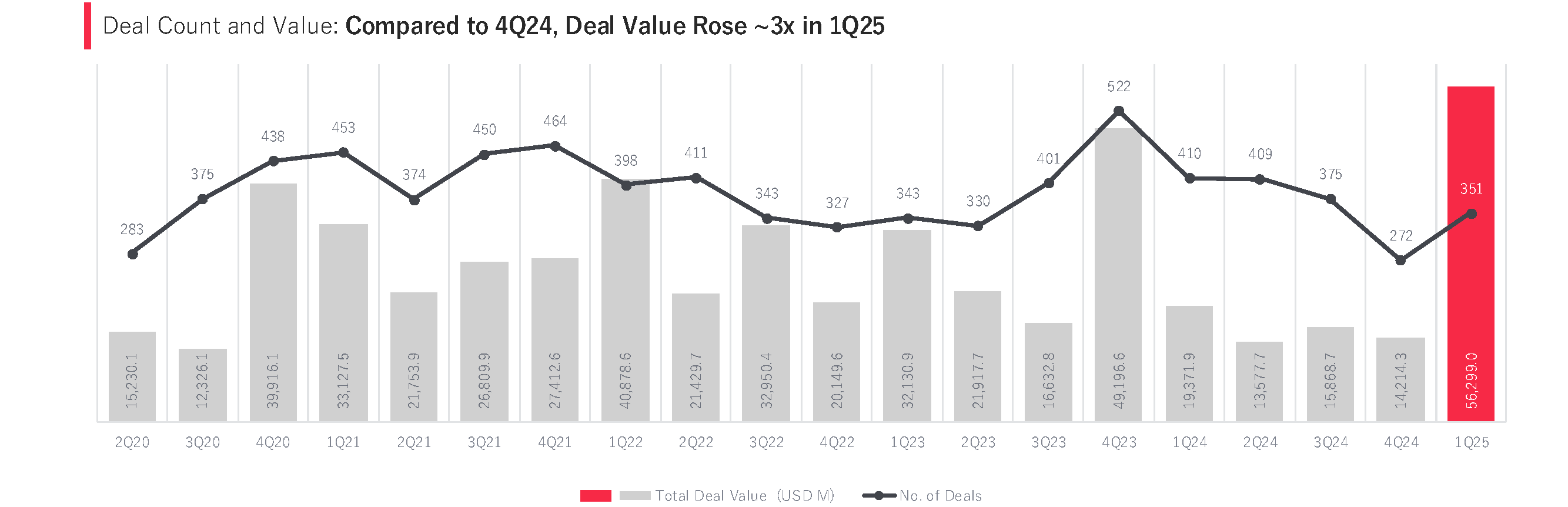

Southeast Asia’s M&A activity saw a dramatic resurgence in the first quarter of 2025, with deal value surging by 296.1% QoQ. This spike was largely attributable to large-scale restructuring of Indonesian state-owned enterprises (SOEs), which contributed a commanding 71.6% of total deal value. These government-led transactions, primarily in the finance, telecommunications, and industrial sectors, marked a strategic reallocation of assets under the sovereign wealth umbrella of PT Biro Klasifikasi Indonesia (BKI). Major players such as PT Bank Mandiri and PT Bank Rakyat Indonesia, with assets exceeding USD 150 billion and USD 120 billion respectively, were among the flagship institutions restructured during this period.

While the Indonesian government technically transferred its Series B shares in these entities, it maintained effective control through the retention of Series A shares, preserving majority ownership and decision-making power.

This nuanced restructuring approach signals an intent to professionalise state asset management without relinquishing strategic oversight. The creation of Danantara, a sovereign wealth fund managing roughly USD 900 billion in assets, underscores this intent, consolidating government holdings under a unified framework aimed at improving operational efficiency and economic returns.

| M&A Growth Extends Beyond State-Led Deals

Crucially, even when excluding these substantial Indonesian SOE deals, the broader Southeast Asian M&A market still recorded a 12.3% increase in deal value and a 29.0% rise in volume compared to the previous quarter. This indicates that the overall market recovery is not solely dependent on state intervention but reflects a modest rebound in private sector activity as well.

Cross-Border Activity and Inter-Regional Deals Rebalance

| Intra-Regional Transactions Gain Momentum

While state-led restructuring in Indonesia dominated overall M&A value, cross-border and inter-regional deal activity in Southeast Asia also displayed noteworthy trends in 1Q25, underscoring a broader rebalancing of investment flows. Inter-regional transactions—defined as deals occurring between two Southeast Asian countries—accounted for a commanding 76.8% of total deal value, up sharply from 44.3% in the previous quarter. This reflects a resurgence in intra-regional confidence, likely spurred by state-led signals and recovering fundamentals across key markets.

| Outbound Expansion and Singapore’s Pivotal Role

Conversely, although the share of inbound and outbound deal value fell by 23 and 10 percentage points respectively, their transaction volumes told a different story. Inbound deal count rose by 48% QoQ, while outbound surged by an impressive 118%. This divergence between value share and deal count suggests a higher number of mid-sized or smaller transactions—especially by Singaporean companies expanding into markets such as the United States and India. These outward investments hint at a renewed appetite for overseas diversification amid global supply chain recalibrations and rising protectionist pressures.

Moreover, cross-border deal value still grew by approximately 9% compared to the previous quarter, despite the overall decline in share. Singapore, in particular, played a pivotal role in this growth, continuing to act as a regional hub for both outbound capital and inbound interest. Meanwhile, the rising number of domestic deals across the region slightly diluted inter-regional deal volume share, but this was more a reflection of improved local economic sentiment rather than a drop in regional collaboration.

Sector Performance: Finance, Consumer, and Emerging Leaders

| Finance and Consumer Sectors Lead Deal Activity

The financial services sector was the undisputed leader in Southeast Asia’s M&A landscape for 1Q25, driven almost entirely by Indonesia’s restructuring of state-owned financial institutions. Finance and Banking accounted for approximately 59% of total deal value, a result of high-profile transactions involving PT Bank Mandiri, PT Bank Rakyat Indonesia, and PT Bank Tabungan Negara. These deals, each valued in the billions of US dollars, not only elevated the sector’s prominence but also skewed the overall industry breakdown. When adjusting for these state-led deals, the Finance sector’s share dropped sharply to just 14%, revealing the significant weight of SOE-driven influence in the headline figure.

Consumer Services ranked second by deal value, led by the restructuring of PT Telkom Indonesia and the high-profile acquisition of Malaysia Airports Holdings Berhad (MAHB) by a Singapore-led consortium. The MAHB deal alone was valued at MYR 18.4 billion (~USD 3.9 billion), contributing heavily to Malaysia’s lead in startup M&A activity during the quarter. This transaction exemplifies a growing trend of regional privatisation and delisting efforts, which may pave the way for operational restructuring and longer-term value creation.

| Rise of Strategic and Sustainable Sectors

Outside of these headline sectors, Mining and Agriculture emerged as high-median-value industries, underscoring strategic shifts in resource security and food supply resilience. Notable deals included the USD 85 million acquisition of Strong Built (Mining) Development in the Philippines and a USD 70 million investment in Bahodopi Nickel Smelting in Indonesia. These deals reflect broader themes such as localisation of critical inputs and alignment with Western tax credit frameworks.

In addition, sectors like Logistics, Renewables, and Agritech began to register stronger interest, particularly at the startup level, where innovation-driven sustainability goals are intersecting with policy incentives. This suggests a potential pivot in future quarters towards more diversified sectoral activity beyond the current heavy reliance on finance and consumer services.

Startup Ecosystem: Malaysia and the Philippines Dominate

| Landmark Deals Highlight Malaysia and Philippine Strengths

In 1Q25, Malaysia and the Philippines led Southeast Asia’s startup M&A landscape, both in terms of deal value and strategic impact. Malaysia topped the charts with the landmark take-private transaction of Malaysia Airports Holdings Berhad (MAHB), valued at approximately USD 2.8 billion. This single deal represented around 61% of total startup M&A deal value for the quarter and was driven by a Khazanah Nasional-led consortium that included the Employees Provident Fund (EPF), Global Infrastructure Partners (GIP), and the Abu Dhabi Investment Authority (ADIA). The transaction underlines Malaysia’s continued ability to attract large-scale, sovereign-backed investment into strategic infrastructure assets.

The Philippines, meanwhile, emerged as a rising player with a series of significant renewable energy and logistics transactions. Key deals included a USD 600 million investment by Actis Rubyred in Terra Solar Philippines Inc. and I Squared Capital’s USD 348 million acquisition of Philippine Coastal Storage. Together, these transactions reflect a broader investor shift toward scalable, future-proof sectors such as energy transition and critical logistics infrastructure. Moreover, the involvement of global infrastructure and private equity players signals growing confidence in the Philippines as a market for long-term, asset-backed investments.

| Investor Focus Shifts to Later-Stage Startups

What is particularly notable about 1Q25’s startup activity is the clear concentration in later-stage deals. The vast majority of the quarter’s deal value was tied to companies beyond the Series A stage, with early-stage (seed and pre-seed) deals accounting for less than 1% of total value. This trend suggests investors remain cautious about venture-level risks and are favouring mature, revenue-generating firms with clear paths to scalability or exit.

Private Equity Reigns Across Startup and Mature Deals

| Private Equity Dominates Startup Investment Landscape

Private equity (PE) emerged as the dominant force in Southeast Asia’s M&A landscape during 1Q25, accounting for approximately 93% of all startup M&A deal value. This trend reflects a broader regional risk posture that favours more mature, revenue-generating businesses over early-stage startups, particularly in an environment characterised by geopolitical uncertainty, rising capital costs, and heightened scrutiny on valuation discipline. While venture capital and angel investments have historically played a formative role in emerging markets, their relative contribution was minimal this quarter, with seed and pre-seed funding representing less than 1% of disclosed deal value.

| SOE Restructuring Aligns with Private Equity Strategy

The PE-driven nature of M&A extended beyond startups into mature sectors as well, particularly in government-led transactions. The restructuring of Indonesian SOEs—such as Bank Mandiri, Bank Rakyat Indonesia, and Telkom Indonesia—although publicly initiated, closely aligned with the typical private equity investment thesis: operational streamlining, governance enhancements, and long-term value realisation. These deals also enabled large pools of capital—such as those managed under Indonesia’s sovereign wealth entity Danantara—to take concentrated positions in key economic assets, consolidating control while introducing private sector discipline.

| Private Equity Embraces Long-Term, Asset-Backed Strategies

Importantly, private equity’s dominance in 1Q25 was not limited to financial engineering or traditional buyouts. Investments in infrastructure, renewables, and logistics demonstrated a clear pivot toward long-duration, asset-backed strategies. For instance, deals in renewable energy (e.g., Gentari’s USD 900 million acquisition of Brookfield’s assets in India) and logistics (e.g., investments in EV supply chains and hydrogen innovation) showcased the increasing alignment between private equity capital and sustainability-focused growth.

This capital preference underlines a shift in Southeast Asia’s M&A ecosystem: while innovation remains vital, institutional investors are clearly prioritising scale, control, and strategic fit. The implication for the region is twofold—on one hand, PE’s maturity can elevate governance and operational benchmarks; on the other, limited early-stage support may slow the pipeline of disruptive startups in future cycles. Still, with resilient macro fundamentals and increasing state-PE collaboration, the region appears set for structurally stronger, if more selective, M&A activity in the quarters ahead.

Explore M&A Insights in ASEAN with Speeda

Sign up to read the full report with in-depth M&A and macroeconomic insights. Whether you’re tracking M&A trends, economic performance, or business changes, Speeda M&A report equips you with data-rich, analyst insights to drive strategic decision-making.

Thank you for your submission!

We will send an email with the download link to access the report shortly.

Follow our Linkedin Page !

Our latest updates on

ASEAN reports and webinars are posted here.