Trend Reports

Download Report | Southeast Asia M&A 2Q25 Insights

Summary

Thailand and Singapore drove Southeast Asia’s 2Q25 M&A activity, with steady core deals despite a drop in headline mega-deal value.

Southeast Asia M&A 2Q25 Insights

| Where Will the Next Investment Targets Emerge?

For private equity firms and financial investors, Southeast Asia’s M&A market remains a critical source of opportunities. While headline deal values showed a steep quarterly drop in M&A 2Q25, the underlying reality is more resilient. Excluding one-off state-owned enterprise restructurings, deal value in fact expanded and volumes held steady. In this review, we explore the quarter’s M&A landscape to uncover where the opportunities and future investment potential lie

Deal Activity Holds Steady Despite Headline Decline

| Market Normalises: Hidden Growth Behind the Headline Decline

Southeast Asia’s mergers and acquisitions (M&A) market witnessed a sharp 60.9% QoQ fall in deal value in 2Q25, largely reflecting the absence of the outsized Indonesian state-owned enterprise (SOE) restructurings that had defined the previous quarter. These one-off transactions created an inflated base in 1Q25, making the 2Q25 decline appear more dramatic than the underlying reality. When these exceptional transactions are excluded, deal value in fact grew by 21.9% QoQ. Deal volume remained broadly flat, edging down only 0.8%.

This underlines that core deal-making activity remains steady despite the absence of headline mega-deals. The market is therefore normalising after an extraordinary quarter, reverting to a healthier balance between large strategic deals and a steady flow of smaller transactions. This resilience demonstrates a more sustainable trend in Southeast Asia’s deal pipeline.

| Cross-Border Shifts Reinforce Southeast Asia’s “China Plus One” Role

Underlying sentiment remained cautious as global uncertainties—from inflationary pressures to geopolitical risks—continued to influence decision-making. Inter-regional deal value share fell 14 percentage points compared with 1Q25, a shift that coincided with a marked reduction in large intra-regional restructurings.

However, inbound and outbound activity gained share, rising 6 and 8 percentage points respectively, even though their absolute values fell significantly (inbound down ~40%, outbound down ~23%). Volumes tell a slightly more encouraging story: inbound deals held steady, confirming Southeast Asia’s enduring appeal under the “China Plus One” (CP1) diversification strategy, while inter-regional volumes increased by ~9% QoQ. This suggests that despite caution, dealmakers continue to view Southeast Asia as an attractive base for both expansion and consolidation.

Mega-Deals and Diversification Set the Quarter’s Tone

| Energy, Telecom, and Renewables Lead Strategic Mega-Deals

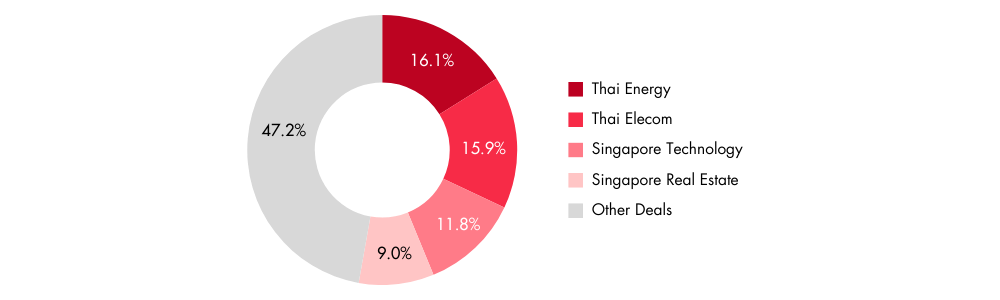

The most significant drivers of 2Q25’s deal activity were strategic consolidations in the telecom and energy sectors, underscoring a broader trend of domestic consolidation in core infrastructure sectors.

[2Q25 M&A Deal Mix by Geography and Industry]

Thai billionaire Sarath Ratanavadi executed two transformative acquisitions: Gulf Energy Development and Intouch Holdings. These moves consolidated control over critical energy and telecom assets, reshaping Thailand’s corporate landscape and accounting for nearly one-third of total deal value in the quarter. Beyond Thailand, sustainability and diversification emerged as powerful themes. Foxconn injected USD 1.5 billion into Yuzhan Technology to expand its iPhone component manufacturing in India, reflecting an acceleration of supply chain relocation beyond China. Meanwhile, Singapore’s Seraya Partners boosted its stake in Empyrion, a green data centre operator, signalling robust demand for digital infrastructure aligned with low-carbon strategies. Collectively, these drivers highlight the dual focus of Southeast Asia’s M&A landscape: domestic consolidation by local champions and cross-border investments aligned with global megatrends.

| Tariff Certainty and Rate Cuts to Boost Inbound Activity

Another crucial factor shaping deal sentiment in 2Q25 was the confirmation of new US tariff structures for Southeast Asian economies. With clearer visibility on tariffs—10% for Singapore, 20% for Vietnam and the Philippines, and 25% for Malaysia—investors are better able to model costs and returns. Vietnam’s reduced tariff rate (from 46% to 20%) triggered a rally in the VN Index, signalling renewed investor confidence and a likely resurgence in manufacturing-related inbound deals. At the same time, macroeconomic fundamentals are turning more supportive. Inflation is easing across the region, and interest rate cuts are anticipated in several markets, creating favourable financing conditions. Together, these trends are expected to underpin a stronger rebound in inbound M&A in the second half of 2025, particularly in capital-intensive and high-margin industries such as advanced manufacturing, logistics, and renewable energy.

Source: Sixth Street

Thailand and Singapore Dominate Regional Deal Value

| Thailand: Surges with Landmark Energy and Telecom Acquisitions

Thailand emerged as the standout performer in 2Q25, with M&A deal value surging nearly 21 times compared with the previous quarter. The lion’s share of this growth was driven by two public equity acquisitions by Sarath Ratanavadi. By acquiring the remaining stakes in Gulf Energy Development and Intouch Holdings, he merged them into Gulf Development Public Company Limited, consolidating strategic assets across energy and telecommunications. The deals represented ~98% of Thailand’s total deal value for the quarter and vaulted the country into second place in Southeast Asia by deal value, up from sixth in 1Q25. The consolidation not only reinforced Thailand’s relevance in regional deal-making but also highlighted how high-profile domestic entrepreneurs continue to shape the M&A landscape.

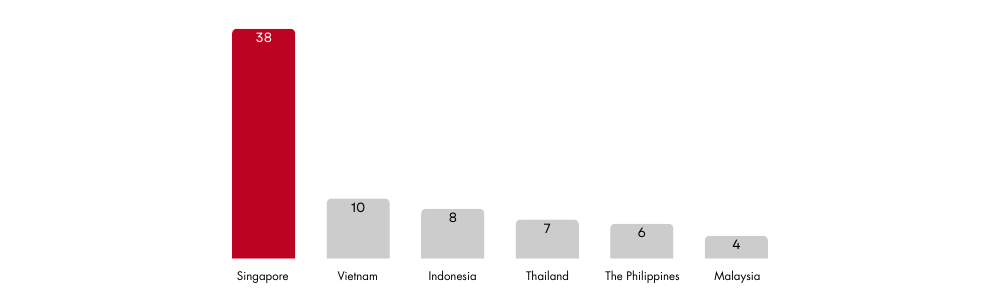

| Singapore: Retains Lead in Large-Scale, High-Value Deals

Singapore continued to serve as the region’s anchor for high-value transactions. In 2Q25, the city-state hosted several landmark deals, including Cuscaden Peak’s USD 2.2 billion acquisition of Paragon REIT, JSW Neo Energy’s USD 1.5 billion purchase of O2 Power Midco Holdings, and Foxconn’s strategic capital injection into Yuzhan Technology. These large-scale transactions ensured Singapore retained its top spot for median deal values. Its role as a financial hub, supported by a transparent regulatory framework and deep pools of capital, continues to attract both domestic and international investors seeking scale and stability. Singapore’s dominance in sectors such as real estate, renewable energy, and advanced technology further solidified its status as Southeast Asia’s M&A hub.

[Median Deal Value (USD M) by Region 2Q 2025]

| Mining and Renewables Show Strong Cross-Border Appeal

Cross-border appetite remained robust in mining and renewables, sectors that recorded some of the highest median deal values in the quarter. Major acquisitions included CMOC Singapore’s purchase of Lumina Gold in Ecuador and SeaBird Exploration’s acquisition of Energy Drilling in Singapore. These deals highlighted how resource-backed assets and offshore energy services continue to attract global investors. In the renewables space, JSW Neo Energy’s entry into Singapore underscored the demand for sustainable infrastructure, with capital flowing into solar and low-carbon projects. The willingness of international buyers to commit to large-scale projects in these sectors demonstrates Southeast Asia’s growing role in meeting global resource and energy diversification needs.

Source: PIB

Thai Mega-Deals Define Quarter, Advisors Cement Influence

| Two Thai Mega-Deals Lead the Region’s M&A Rankings

Two Thai acquisitions defined the quarter’s landscape: Gulf Energy Development (~USD 3.86 billion) and Intouch Holdings (~USD 3.82 billion). Together, these transactions not only accounted for nearly USD 8 billion in deal value but also set the tone for the quarter’s overall performance. They reinforced Thailand’s emergence as a major player in Southeast Asian M&A and highlighted the increasing weight of domestic champions in shaping the regional ecosystem. By consolidating energy and telecom assets, Sarath Ratanavadi demonstrated how strategic domestic acquisitions can have regional implications, particularly when they affect core infrastructure industries.

| Key Advisors Behind High-Value Transactions

The execution of these complex, high-value deals underscored the importance of experienced financial and legal advisors. Discover Management and Avantgarde Capital were key financial advisors to the Thai mega-deals, while Citigroup played a prominent role in Singapore’s transactions, including the Paragon REIT deal. On the legal side, international firms such as Skadden Arps and Norton Rose Fulbright, alongside regional leaders like Allen & Gledhill, provided critical transaction support. Their involvement highlights the continued reliance on top-tier advisory expertise to navigate the complexities of regional and cross-border transactions, especially in sectors characterised by regulatory sensitivity and capital intensity.

Start-up Deals: Concentrated in Singapore’s Tech and Logistics

| Singapore Dominates with Mega Logistics and Tech Deals

Singapore was the undisputed leader in start-up M&A in 2Q25, accounting for nearly 98% of total start-up deal value. The standout was MEGA BidCo’s USD 4.2 billion buyout of ESR Group, a logistics asset-management platform. This transaction led to ESR’s delisting and repositioning as a private company, enabling a leaner operating model and long-term strategic flexibility. Alongside this, Empyrion DC raised USD 828 million to expand sustainable data centres across Asia, catering to surging demand from AI and cloud workloads. Supabase’s USD 200 million funding further illustrated how advanced technology platforms are drawing global investor attention. Together, these deals reaffirm Singapore’s role as the gateway for technology and logistics investments in Southeast Asia.

| Private Equity Remains the Preferred Investment Vehicle

Private equity investors continued to dominate start-up M&A, accounting for 86.3% of total deal value in 2Q25. This preference reflects risk aversion in the current climate, with investors favouring relatively mature companies with established business models and clearer paths to profitability. By contrast, early-stage venture capital and angel investments were subdued, underscoring the limited appetite for high-risk bets in a volatile global environment. Later-stage investments, such as Series C and beyond, attracted greater interest, while “not disclosed” categories captured large-scale funding rounds, including ESR’s privatisation and Empyrion’s raise. This skew towards private equity highlights the cautious, value-driven approach that continues to shape investment in Southeast Asia’s start-up ecosystem.

| Outlook: Cautious but Strengthening Momentum

Despite a headline decline in deal value, Southeast Asia’s M&A market in 2Q25 demonstrated underlying resilience and positive momentum. The market’s ability to sustain volumes and record 21.9% growth in underlying deal value—once outsized SOE transactions are stripped out—shows that the core ecosystem is healthy. Thailand’s transformational acquisitions reshaped its energy and telecom sectors, while Singapore once again showcased its stability as a hub for high-value transactions. Mining and renewables reflected strong cross-border demand, while start-up M&A was anchored by mega-deals in logistics and advanced technology. Looking ahead, tariff clarity, easing inflation, and anticipated monetary policy support create the conditions for cautious optimism. Inbound M&A is expected to strengthen in 2H25, especially in high-margin industries aligned with sustainability and digitalisation. However, global uncertainties—from geopolitics to regulatory changes—remain watchpoints that could shape the pace of recovery. Overall, the outlook for Southeast Asian M&A is one of cautious but strengthening momentum, with the region positioned as a critical beneficiary of global diversification and sustainability strategies.

| Explore M&A Insights in ASEAN with Speeda

Sign up to get instant access to in-depth M&A and macroeconomic insights like this report—plus exclusive coverage across ASEAN markets. Whether you’re tracking M&A trends, economic performance, or business changes, Speeda equips you with data-rich, analyst-written reports to drive strategic decision-making.

Start your free trial today and unlock Speeda’s full suite of M&A reports, ASEAN country reports, and Asian company data.

Thank you for your submission!

We will send an email with the download link to access the report shortly.

Follow our Linkedin Page !

Our latest updates on

ASEAN reports and webinars are posted here.