Trend Reports

ASEAN & India Macroeconomic Summary: Insights from 4Q 2024

Summary

4Q24 ASEAN-5 + India report highlights strong growth in Vietnam and India, with evolving politics, ESG policy, and youth-driven market shifts.

Vietnam and India Outperform, While Thailand Lags on Growth

| Domestic Demand and FDI Fuel Growth Across Key Markets

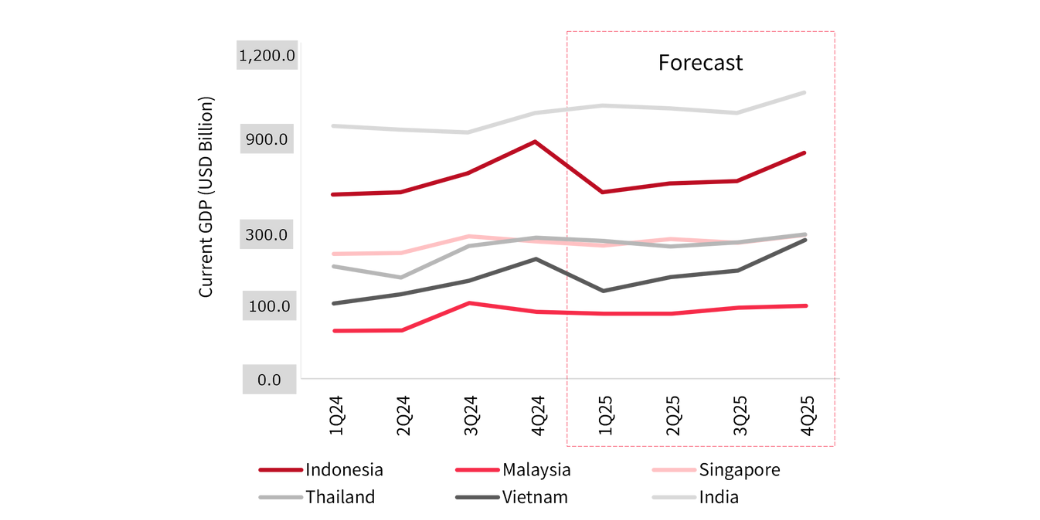

Despite global headwinds, the ASEAN-5 and India recorded moderate economic growth in 4Q24, supported by steady domestic demand, production gains, and public investment. Vietnam led with 7.6% YoY GDP growth, followed by India (6.2%) and Indonesia (5.0%). Malaysia and Singapore also posted 5.0% growth, while Thailand lagged at 3.2%.

Trade performance varied. Vietnam and Singapore benefited from strong exports, whereas Thailand’s trade deficit widened due to weak electronics demand. India’s trade deficit also grew, compounded by falling FDI inflows. In contrast, Indonesia and Malaysia attracted higher FDI, especially in manufacturing and finance. Singapore maintained its lead as the top FDI destination, reaffirming investor trust in its stable business environment.

GDP 1Q24-4Q25 | Amid Mild Volatility, ASEAN5+India’s GDP Expected to Rise in 2025

| Inflation Eases in Most Economies, Supporting Rate Stability

Inflation was mostly contained. It eased in Indonesia, Malaysia, and Singapore but rose modestly in Vietnam and Thailand due to higher energy and food prices. India’s inflation, while highest at 4.3%, improved from prior levels as food prices moderated. Monetary policy was largely stable across the region, with Singapore and Thailand opting for rate cuts in response to easing inflation and softening external demand.

Overall, while growth momentum varied, domestic consumption and investment continued to underpin regional stability. With inflation moderating and rates poised to ease further, 2025 growth prospects remain cautiously positive, though external trade risks persist.

Political Stability Diverges, With India and Vietnam Showing Firm Ground

| India and Vietnam Maintain Stability Through Reforms and Policy Continuity

Political developments across the ASEAN-5 and India in 4Q24 showed clear divergence. India and Vietnam remained politically stable, while Thailand, Malaysia, and Indonesia experienced varying degrees of uncertainty. India maintained strategic policy continuity, with the Union Budget 2025–26 promoting AI, MSMEs, and start-ups. The peaceful Jammu and Kashmir elections further underscored institutional stability.

Vietnam also sustained reform momentum, pushing ahead with administrative restructuring to enhance government efficiency. Singapore remained stable overall, though upcoming elections and cost-of-living concerns may stir stronger opposition. Nevertheless, its diplomatic balance between the US and China demonstrated political maturity.

| Instability in Thailand, Malaysia, and Indonesia Weighs on Confidence

In contrast, Thailand’s political landscape grew more volatile. The Pheu Thai-led coalition faced internal rifts, weak public support, and external pressure from potential shifts in US trade policy. These factors undermined investor confidence in policy direction and governance reliability.

Malaysia faced domestic turbulence despite positive diplomatic developments with Japan. Public trust weakened due to political controversies, which may limit the impact of newly introduced reforms. In Indonesia, policy inconsistency became apparent as the government reversed a planned VAT hike following electoral wins by Prabowo’s party. While joining BRICS and securing Japanese infrastructure loans showed promise, governance coherence remained in question.

Youth-Driven Trends Reshape Consumer Behaviour Across the Region

| Millennials and Gen Z Lead Digital and Sustainable Shifts

Shifting demographics and digital adoption are reshaping the social landscape across ASEAN-5 and India, with Millennials and Gen Z driving changes in consumption, work, and wellness. India, Vietnam, and Malaysia are advancing rapidly in digital payments, health awareness, and sustainable living, while Thailand and Singapore face challenges in aligning workforce expectations and economic pressures.

India saw strong white-collar hiring in IT, pharma, and energy, supported by Global Capability Centres and the Digital India initiative. While households increased discretionary spending, essential goods still dominated budgets. In Vietnam, eco-conscious Gen Z consumers embraced a blend of sustainability and digital convenience, reflecting a broader lifestyle transition.

| Rising Cost Sensitivity and Lifestyle Diversity Shape Markets

In Malaysia and Indonesia, mobile-first habits are accelerating social commerce. Underconsumption and minimalist values are gaining ground, particularly among youth. Malaysian consumers are increasingly focused on financial prudence, while Indonesians are embracing wellness and local lifestyle preferences, combining cultural tradition with aspirational living.

Singapore and Thailand are dealing with more complex social shifts. In Singapore, people prioritise health and family time, but concerns over rising living costs persist. Despite this, its high digital adoption supports lifestyle integration. Thailand, meanwhile, is experiencing friction between employer and employee work-life balance expectations, which could affect long-term workforce engagement. While health-consciousness is growing, price sensitivity continues to shape food and lifestyle decisions.

Digital Infrastructure and AI Lead Regional Innovation Push

| India, Singapore, and Vietnam Drive Tech-Forward Agendas

ASEAN-5 and India are accelerating digital transformation with strong government and private sector support in AI, cloud computing, and digital infrastructure. India, Singapore, and Vietnam lead this shift, while Malaysia and Indonesia are progressing with targeted policies. Thailand, despite activity in fintech and robotics, faces greater execution hurdles.

India’s Union Budget 2025–26 highlighted investments in AI and IT infrastructure, aligning with its dynamic private sector. The country’s vast talent pool and widespread adoption of digital payments via UPI form a solid foundation for continued innovation. Vietnam is also rising as a digital contender, addressing its IT talent gap through investments in AI, blockchain, and STEM education—balancing infrastructure growth with workforce upskilling.

Singapore remains the regional tech leader. Its Smart Nation 2.0 plan, AI funding, and regulatory clarity support digital currency trials and green technology adoption. These initiatives reinforce Singapore’s reputation as a global innovation hub, underpinned by stable governance and investor confidence.

| Progress in Malaysia and Indonesia, But Gaps Remain in Thailand

Indonesia and Malaysia advanced notably in 4Q24. Indonesia’s focus on satellite internet and agri-tech aims to improve rural connectivity, while Malaysia’s partnerships with US tech firms and RFID adoption signal progress in digital readiness. However, both face challenges in scaling due to cybersecurity gaps and regulatory complexity.

Thailand’s efforts in fintech and AI are hindered by fragmented frameworks and inconsistent policy delivery. Despite interest in automation, the lack of coherent data governance may slow momentum.

Note: *RFID- Radio Frequency Identification

Stronger Green Commitments, But Investor Confidence Varies

| Singapore and Vietnam Lead with Clearer ESG Frameworks

In 4Q24, ASEAN-5 and India advanced environmental regulation and ESG initiatives, but market confidence and execution strength varied. Singapore and Vietnam led with clearer frameworks and stronger alignment between policy and investment sentiment, while India and Thailand saw weaker ESG index performance. Malaysia and Indonesia made regulatory progress, but challenges remain in driving widespread implementation.

Singapore continued to set the regional benchmark, requiring listed companies to disclose Scope 1 and 2 emissions from 2025 under IFRS S2 standards. Its low-carbon index outperformed the broader market, reflecting investor trust in its green strategy, which is underpinned by smart urban planning and climate finance integration.

Vietnam also moved forward, introducing Decree 05/2025 to enforce carbon inventories and environmental fees. Combined with green tax incentives and waste management reforms, these actions strengthened Vietnam’s green credentials, although investor enthusiasm remains cautious in the near term.

| Mixed Progress in ESG Execution Across Malaysia, Thailand, and India

Malaysia and Indonesia focused on energy efficiency. Malaysia’s Energy Efficiency and Conservation Act and plans for sustainable aviation fuel (SAF) suggest medium-term potential. Indonesia expanded carbon initiatives through its green industry roadmap, but ESG-related capital inflows remain slow, underscoring enforcement challenges.

Thailand’s community-level projects in carbon credits and waste were notable, yet its Thaipat ESG index fell 8.3% in 4Q24, pointing to weak investor confidence. India also introduced new environmental rules, including plastic waste management and vehicle recycling, but its ESG indices declined sharply, reflecting concerns about implementation capacity.

*Notes: ESG – Environment, Social and Governance | SAF- Sustainable Aviation Fuel

Legal Reforms Aim to Attract Investment but Vary in Depth

| Vietnam and Malaysia Lead With Broad-Based Incentives

In 4Q24, ASEAN-5 and India introduced diverse legal and tax reforms to strengthen their investment climates, though the scope and clarity of these measures varied. Vietnam and Malaysia led with broad-based incentives and regulatory updates, while Singapore and India focused on aligning with international standards. Indonesia and Thailand made moves as well, but implementation clarity remains a concern.

Vietnam extended its 2.0% VAT reduction through mid-2025 and introduced green investment incentives alongside updated environmental compliance rules—positioning itself as increasingly attractive for manufacturing and export-oriented sectors. Malaysia, meanwhile, revised its Personal Data Protection Act and eased tax burdens through targeted concessions, benefiting both digital and traditional businesses.

| Regulatory Alignment Varies, With Singapore and India Ahead

Singapore maintained legal stability while introducing a 15.0% top-up tax for large multinationals, in line with OECD BEPS 2.0 standards. Though it slightly raises the effective tax rate, the move reinforces Singapore’s global reputation for regulatory compliance, which is key to sustaining foreign investor confidence.

India proposed six major legal reforms in its Union Budget 2025/26, centred on supporting corporates and MSMEs. While most tax rules remained unchanged in 4Q24, the structural focus suggests long-term continuity. However, the breadth of India’s administrative system may delay impact realisation.

Indonesia’s VAT increase to 12% was later narrowed to luxury goods, creating temporary confusion. Thailand also introduced a top-up tax and regional investment incentives, but limited policy detail and legal fragmentation may hinder investor response.

Sign up to read the full report of the ASEAN Country (ASEAN5 +India) Summary Report.

Thank you for your submission!

We will send an email with the download link to access the report shortly.

Follow our Linkedin Page !

Our latest updates on

ASEAN reports and webinars are posted here.