Trend Reports

Download Report | Southeast Asia M&A Activities

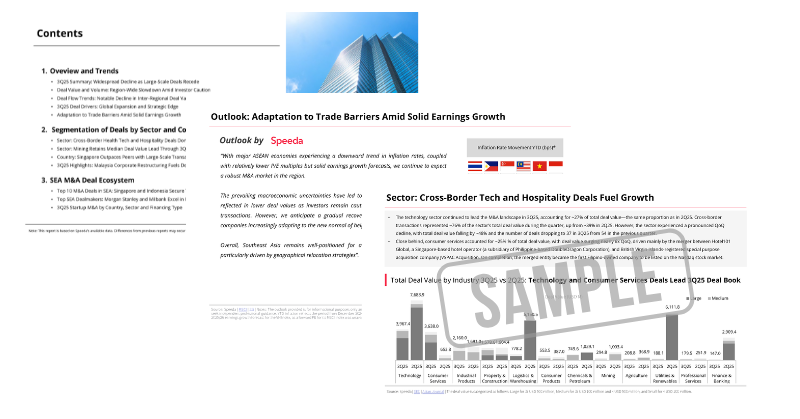

Key Highlights of 3Q M&A Activities

M&A activity across Southeast Asia softened markedly in 3Q25, reflecting the impact of tightening regulatory environments, delayed decision-making, and a slowdown in large-scale transactions. Total deal value fell 49.9% QoQ, while deal volume declined 27.1%, keeping overall activity below the five-year 3Q average. Singapore continued to lead the region in M&A deal value, outpacing peers with large-scale transactions.

Inter-regional deal value recorded a notable pullback in 3Q25. While cross-border transactions continued to make up the majority of deal value—driven by companies seeking international scale and strategic advantages—the category also weakened. Overall cross-border deal value fell by ~22% QoQ, largely due to a sharp ~38% drop in inbound deals, signalling more cautious foreign investor sentiment.

Key Sector and Startup M&A Highlights

The Technology sector remained a key driver of the M&A landscape, yet its total deal value saw a significant Quarter-on-Quarter decline. In contrast, the Consumer Services sector experienced a sharp surge—rising nearly sixfold QoQ—largely fuelled by the merger of Hotel101 Global.

Startup M&A remained concentrated in Singapore, which captured 86.0% of regional startup deal value. Healthcare/Health Tech and Advanced Technology continued to drive momentum, underpinned by transactions such as: Tamarind Health’s buyout of TalkMed Group and Supabase’s capital raise, These deals highlight ongoing interest in high-growth, innovation-driven verticals despite broader market caution.

Explore the Full Report

Although 3Q25 experienced a temporary slowdown, analysts expect deal activity to stabilise as macroeconomic uncertainties ease. Key ASEAN markets are recording lower inflation, moderating valuation multiples, and steady earnings forecasts, providing room for renewed investor appetite.

Sign up to get instant access to in-depth M&A and macroeconomic insights. Whether you’re tracking M&A trends, economic performance, or business changes, Speeda equips you with data-rich, analyst-written reports to drive strategic decision-making.

Table of Contents

ー Overview and Trends

- 3Q 2025 Market Summary

- Deal Value and Volume Movements

- Deal Flow Trends (Cross-Border & Inter-Regional)

- Key Deal Drivers

- Outlook

ー Segmentation of Deals by Sector and Country

- Sector Analysis

- Country Highlights and Top Deals

ー Southeast Asia M&A Deal Ecosystem

- Top 10 M&A Deals in Southeast Asia

- Top 10 Deal Makers

- Startup M&A by Country, Sector and Financing Type