Beverage Containers Industry Overview in Vietnam 2022

To read the full version of this report, apply for our free trial

Read the Full Article

SPEEDA Industry Report

Our Industry research reports provide you with a fundamental understanding of hundreds of industries ranging from major to niche sectors, including new tech-focused trends. Reports organized by Asia-focused countries are logically structured to cover key information such as market size, value chain, key regulations, competitive landscape, and more.

Users can utilize the industry reports to get a bird's eye of the industry quickly (covered within 3,000 words), also combining it with our extensive private company database to further understand key players and trends related to the specific industry.

The reports focus on below 3 key segments of the industry which assist users with understanding where to focus on for further deep-dive research.

Report Overview - Beverage Containers Industry Overview in Vietnam

Salient Nature/Key Features of the Industry

- Vietnam's beverage container industry is characterised by a dominant presence of foreign players with major a emphasis on sustainability

- The industry consists of the metal can and PET bottle segments with each category accounting for approximately half the of total container consumption volume

- PET bottles are preferred for soft drinks and aluminium cans dominate the beer segment

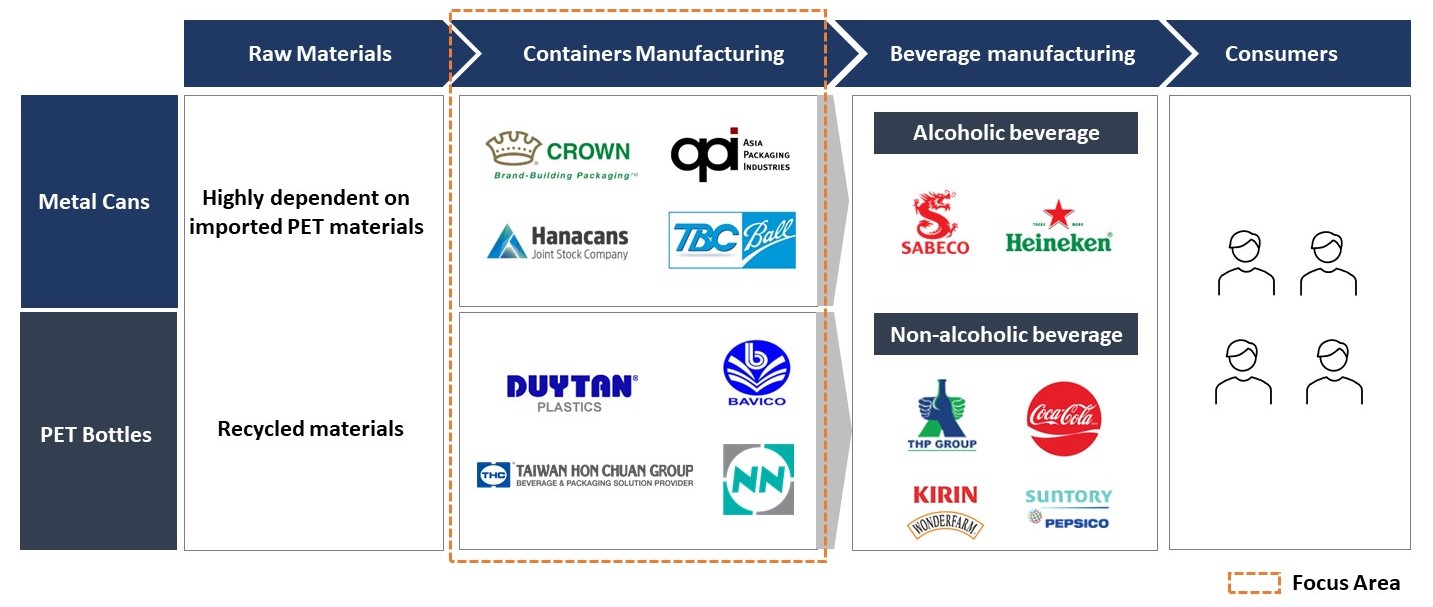

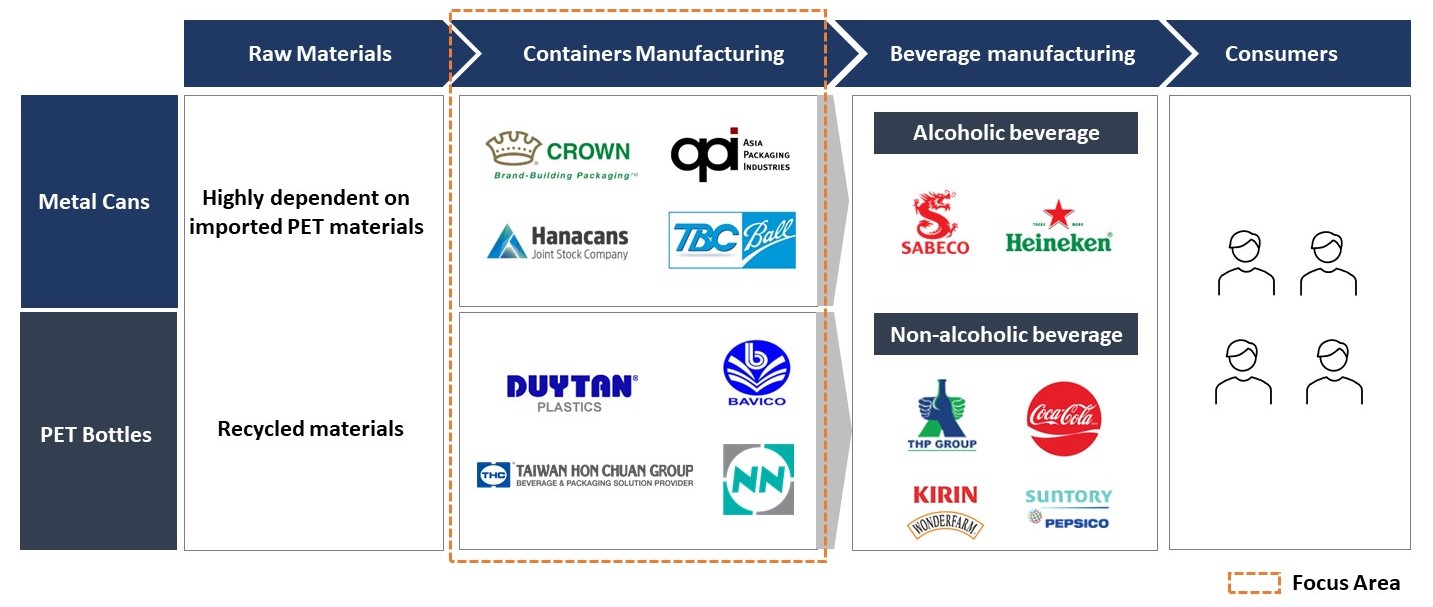

Value Chain/Business Model

- Beverage container producers typically specialise in either metal cans or PET bottles and primarily act as independent suppliers of beverage manufacturers. Some producers have developed strong bonds with beverage manufacturers through capital alliances or partnerships

- Metal can providers procure raw materials domestically while PET bottle producers are dependent on imported plastic materials due to limited domestic production

Others

- New regulation on Environmental Protection with effect from January 2022 makes Extended Producer Responsibility (EPR) scheme mandatory. Under the new scheme, metal and PET packaging product producers are subject to recycling responsibility either through self-recycling or monetary contribution to the Vietnam Environmental Production Fund (VEP) starting from 2024

- Considering the increasing emphasis on sustainable development by the Vietnamese government and global beverage companies, the usage of recycled PET bottles is likely grow within the market

Beverage Containers Industry Value Chain

Report Index

Industry Overview

- Vietnam's Beverage Container Industry Characterised by Dominant Foreign Presence, Major Emphasis on Sustainability

- PET Bottles Preferred for Soft Drinks, Aluminium Cans Dominate Beer Segment

- Beverage Container Producers Build Strong Bonds with Beverage Manufacturers

- New Regulation Compelling Packaging Producers to Recycle Likely to Burden Operators

Market Trends

- Decline in Beer Consumption and Production Hampers Aluminium Can Demand

- Rising Non-Alcoholic Beverage Consumption Fuels Aluminium and PET Packaging Demand

Competitive Trends

- Concentrated Industry Characterised by Dominant Foreign Presence; Players Increasingly Investing in Capacity Expansion

- Crown Beverage Cans Leads Segment

- Ngoc Nghia Top PET Bottle Manufacturer

- Asia Packaging Industries Vietnam a Foreign-Owned Aluminium Can and Bottle Manufacturer