Industry Report: Property Development in Vietnam

To read the full version of this report, apply for our free trial

Read the Full Article

SPEEDA Industry Report

Our Industry research reports provide you a fundamental understanding of hundreds of industries ranging from major to niche sectors, including new tech-focused trends. Reports organized by Asia-focused countries are logically structured to cover key information such as market size, value chain, key regulations, competitive landscape, and more.

Users can utilize the industry reports to get a bird's eye of the industry quickly (covered within 3,000 words), also combining it with our extensive private company database to further understand key players and trends related to the specific industry.

The reports focus on below 3 key segments of the industry which assist users with understanding where to focus on for further deep-dive research.

Report Overview - Property Development - Single-Family Housing Industry Overview in Vietnam 2022

Salient Nature/Key Features of the Industry

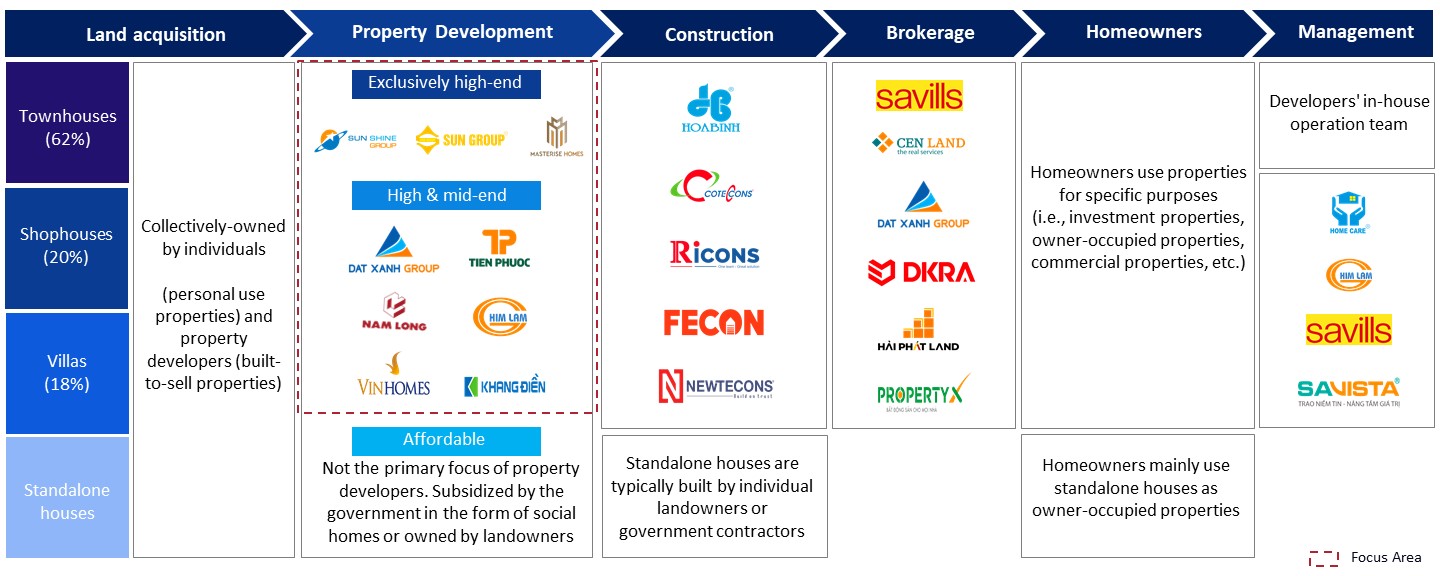

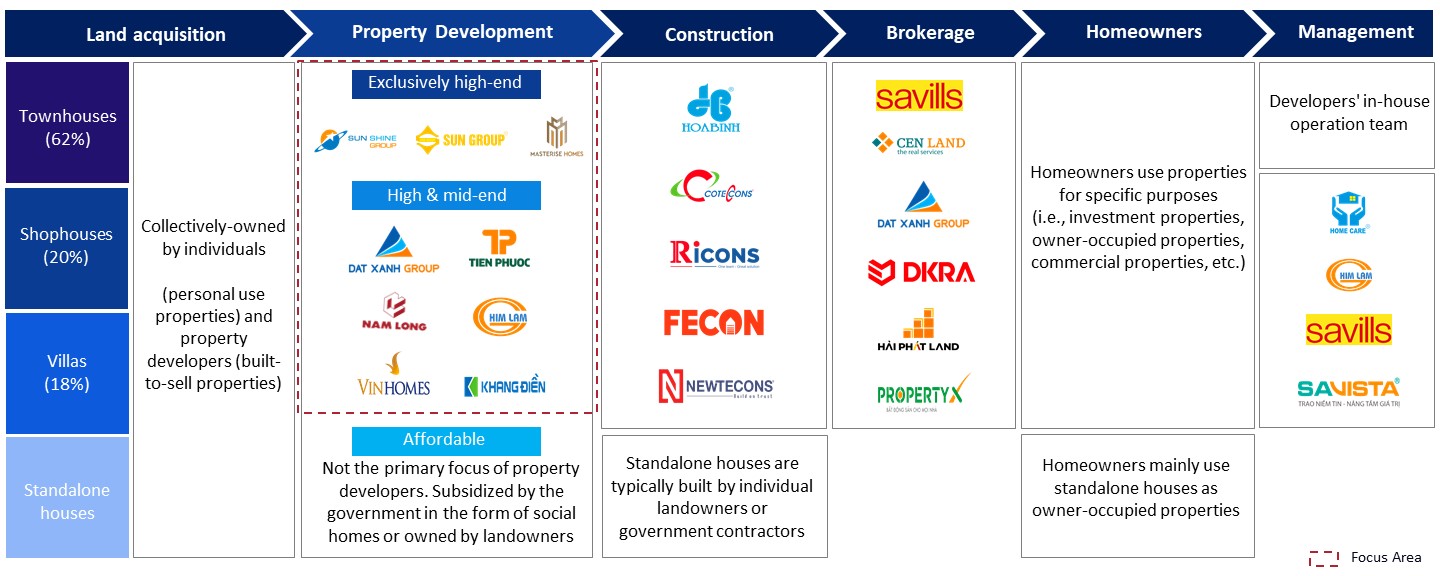

- Townhouses are the most sought-after single-family properties. Townhouses account for 62% of the single-family properties sold in Hanoi and HCMC, followed by shophouses (20%) and villas (18%)

- The industry is highly fragmented, mainly with private real estate developers

Value Chain/Business Model

- Players are segmented by their target market: exclusively high-end property developers vs high- and mid-end property developers

- Exclusively high-end developers build villas in prime locations with first-rate facilities and amenities, targeting high-net-worth individuals and foreign investors

- High- and mid-end property developers offer houses in suburbs and outskirts of urban areas for the middle-income class aside from their luxury properties

- Property developers do not focus on affordable housing. Instead, affordable houses are built by Vietnamese landowners or subsidised by the government

Others

- The typical funding structure of real estate projects in Vietnam is subjected to a high level of risk, with only 15-30% of investment capital being contributed capital. The rest comes from homebuyers’ prepayments, bond issuance proceeds, and bank loans

- The nationwide scandals regarding the bond issuance fraud of two prominent Vietnamese real estate developers in 2022 have led to the tightening of liquidity and a drop in public trust

- Banks limited loans to the real estate sector in early 2022, which further depressed liquidity

Single-Family Housing Industry Value Chain

Report Index

Industry Overview

- Townhouses Account for the Majority of Single-Family Houses in Vietnam; Liquidity Constraints Hamper the Supply of New Houses

- Properties Developers Focus on High-End and Mid-End Market Segments; Affordable Housing is Built by Landowners or Subsidised by the Government

- Open Policies with Few Constraints Encourage Participation from Foreign Homebuyers and Investors

Market Trends

- An Unsound Funding Structure Caused Difficulties in Raising Capital, Resulting from Bond Issuance Scandals and Restrictive Bank Lending Policies

- New Supply Declined Since 2021 Due to COVID-19 and Tight Liquidity Conditions; Hanoi Relied on Existing Projects While HCMC Benefits from New Shophouses by Prominent Developers

Competitive Trends

- Fragmented Industry with Many Private Companies; Large and Listed Property Developers to Recover and Thrive Amid Liquidity Crisis

- Vinhomes: Largest Residential Property Developer in Vietnam

- Khang Dien House: Leading Property Developer in HCMC

- Sunshine Homes: Emerging Exclusive Luxury Property Developer